26 December 2023: The total telecom and pay-TV services revenue in Singapore is forecast to decline at a compounded annual growth rate (CAGR) of 0.2% over the period 2023-2028, despite a rise in subscriptions in mobile data and fixed broadband segments, according to GlobalData, a leading data and analytics company.

GlobalData’s Singapore Telecom Operators Country Intelligence Report reveals that the total mobile subscriptions in the country will increase at a CAGR of 1.4% over 2023-2028, in line with the continued rise in mobile internet subscriptions and smartphone adoption levels, increase in multi-SIM ownership, and growth in M2M/IoT subscriptions.

Aasif Iqbal, Telecom Analyst at GlobalData, comments: “Fixed broadband subscriptions will grow at a CAGR of 1.8% over the forecast period, supported by a continued rise in FTTH/B subscriptions on the back of government initiatives to further expand and upgrade fiber broadband connectivity in the country. Netlink NBN Trust, for example, plans to invest more in densifying and expanding the coverage of its fiber network in the near future, with the goal of having most outdoor sites either close to or fiber ready from the closest fiber node.”

In the pay-TV segment, IPTV will be the sole platform to deliver pay-TV services in Singapore during the forecast period. IPTV subscriptions are estimated to decline at a negative CAGR of 5.3% over 2023-28, due to the accelerated migration of customers to OTT services.

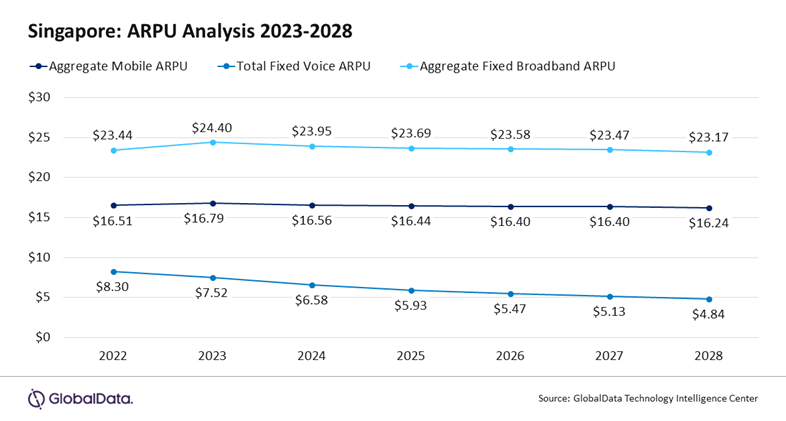

Aasif adds: “Despite the subscription increases in mobile and fixed broadband segments, the revenue from these segments and even fixed voice and Pay-TV segments is poised to decline over the forecast period. This is due to a steady drop in mobile, fixed, and pay-TV service ARPU levels caused by competition-led discounts and promotional pricing plans offered by the operators.”

In terms of market share, Singtel will lead the mobile, fixed voice, fixed broadband, and pay-TV segments in 2023. The operator’s leading position in the mobile segment is primarily supported by its strong foothold in both the prepaid and postpaid segments. The operator is focusing on 5G network development and expansion to compete in the mobile market. In the fixed broadband segment, Singtel’s leading position is supported by its strong presence in the FTTH/B segment, and its strategy to promote discounted fixed broadband plans with additional benefits.

Aasif concludes: “While operators in the mature mobile services segment could focus on service differentiation and tap potential opportunities in the M2M/IoT segment to drive growth, operators in the fixed broadband segment could focus on further expansion and upgradation of fiber-broadband services and devise innovative pricing models and bundled plans to drive growth. In the declining pay-TV service segment, operators may have to build a stronger content library and devise competitive pricing plans to stave off competition from the OTT service platforms and stay relevant in the market.”

+ There are no comments

Add yours