On September 18, 2024, the Indian stock market experienced a notable pullback as benchmark indices, the BSE Sensex and NSE Nifty50, retreated from their recent record highs. This shift came as investors positioned themselves ahead of the anticipated US Federal Reserve policy decision later in the day.

Market Overview

The BSE Sensex closed down 131.43 points, or 0.16%, settling at 82,948.23. Earlier in the trading session, the index reached a new intra-day high of 83,326.38. Similarly, the NSE Nifty50 finished the day at 25,377.55, down 41 points (0.16%) after hitting a record high of 25,482.20.

Key Movers of the Day

In a day marked by volatility, the market saw a mixed bag of performances among its constituent stocks.

- Lagging Stocks: A total of 33 Nifty50 stocks ended in the red, with significant declines from tech giants like TCS, Infosys, HCL Tech, Tech Mahindra, and Wipro, which fell by as much as 3.50%.

- Gainers: On the other hand, 19 stocks managed to close higher. Notable performers included Shriram Finance, Bajaj Finance, Bajaj Finserv, Nestle India, and HDFC Bank, all of which saw gains of up to 4.22%.

Sector Performance

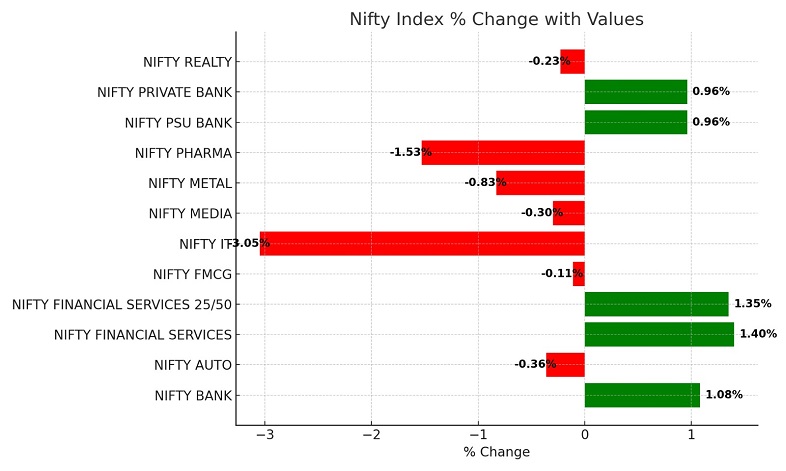

The sectoral performance painted a varied picture:

- BSE Sensex: Among the 30 constituent stocks, 19 ended lower, predominantly dragged down by TCS, Infosys, Tech Mahindra, HCL Tech, and Sun Pharma, which faced declines of up to 3.46%. However, stocks like Bajaj Finance and HDFC Bank managed to rise by up to 3.36%.

- Nifty Index: The Nifty index was notably weak, recording a significant loss of 3.05%. Key contributors to this decline included Mphasis, TCS, and Persistent Systems.

Financial Sector Resilience: In contrast to the tech sector, the financial and banking sectors showcased strength:

- Nifty Financial Services rose by 1.40%.

- Bank Nifty gained 1.06%.

- Both Nifty Private Bank and PSU Bank indices also posted modest gains of up to 0.96%.

Keep an eye out for Business News For Profit market watch reports for a more thorough analysis and professional insights into the market performance. Our dedication to providing precise and prompt information will persist in helping investors make knowledgeable choices in the constantly changing stock market environment.

Disclaimer: The information provided above is for general informational purposes only and should not be considered as financial or investment advice. Stock market investments are subject to market risks, and past performance does not guarantee future results. Always consult with a financial advisor before making any investment decisions.

+ There are no comments

Add yours