New Delhi, Feb 17th: S45 today announced the operationalisation of the nation’s first AI-native investment banking platform amid global conversations at The AI Impact Summit 2026. A VC-backed company supported by RTP Global, S45 has raised $5 million to build and scale its proprietary technology-led infrastructure, designed to deliver institutional-grade precision in the high-stakes world of capital market exits. By augmenting traditional financial expertise through the automation of repetitive, data-heavy administrative tasks, S45 is removing the execution bottlenecks that have historically complicated the IPO journey for high-growth capital markets.

New Delhi, Feb 17th: S45 today announced the operationalisation of the nation’s first AI-native investment banking platform amid global conversations at The AI Impact Summit 2026. A VC-backed company supported by RTP Global, S45 has raised $5 million to build and scale its proprietary technology-led infrastructure, designed to deliver institutional-grade precision in the high-stakes world of capital market exits. By augmenting traditional financial expertise through the automation of repetitive, data-heavy administrative tasks, S45 is removing the execution bottlenecks that have historically complicated the IPO journey for high-growth capital markets.

Commenting on the official platform deployment, Deepank Bhandari, Co-Founder of S45, noted: “India’s capital markets have entered an era of unprecedented scale and maturity, yet the execution frameworks powering most IPOs remain anchored in high-friction, legacy methods that haven’t kept pace with this growth. This disconnect often leaves even the strongest companies navigating a ‘black box’ of fragmented workflows and manual administrative hurdles during their most critical transition. At S45, our strategy is to provide an institutional-grade infrastructure layer that empowers issuers with data-validated precision. By integrating AI-driven governance and real-time demand analytics, we are moving the industry beyond traditional approximation toward a new standard of transparency and execution certainty, fulfilling the promise of ‘AI for All’ in the financial sector.”

Market Impact: A Proven Track Record for High-Growth Exits

Since its pilot phase, the S45 platform has demonstrated the impact of a tech-led approach across 26 IPOs in diverse sectors, including technology, aerospace, healthcare, and industrials. These mandates have already facilitated ₹1,120.8 crore in capital raised, supported by an intelligence layer that tracks investor demand analytics with extreme granularity.

Key performance benchmarks from the platform’s deployments include:

● Substantial Investor Appetite: Mandates recorded an average subscription of 168.4x, with peak demand reaching 325x.

● Massive Bid Volume: The platform generated cumulative investor bids totalling ₹3,64,719 crore.

● Post-Listing Performance: Issuers achieved an average listing gain of 43.1%, while recording an average listing pop of 47.1% over the last twelve months.

The “7-Day” DRHP: Precision Exit Infrastructure

For founders and venture investors seeking efficient pathways to liquidity, S45 introduces a structural redefinition of the listing process. The platform enables an exhaustive IPO readiness assessment in just 30 minutes and utilises an integrated operating system to bring Draft Red Herring Prospectus (DRHP) preparation time down to just 7 days. By embedding AI-driven validation and regulatory process mapping, the system provides boards and CFOs with real-time visibility into their listing journey while ensuring higher compliance consistency and reducing regulatory friction.

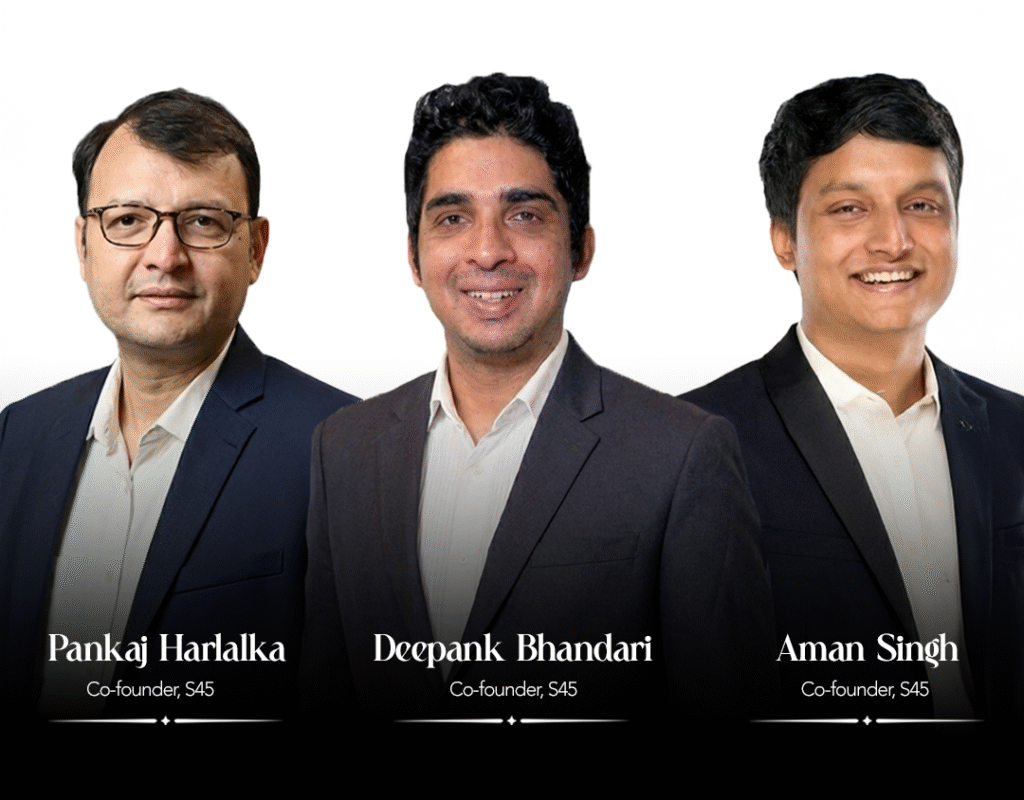

The venture was developed by a multi-disciplinary team of founders -Deepank Bhandari, Pankaj Harlalka, Aman Singh, and Tushar Sharma -who launched S45 to bridge the structural gap in the capital markets execution framework through data engineering and banking expertise.