Indian benchmark indices BSE Sensex and NSE Nifty50 traded decreased in the early hours on Wednesday, reflecting subdued global cues.

The BSE Sensex turned down with the aid of 160.85 factors (0.21%), at 77,978, even as the NSE Nifty50 declined 56.55 factors (0.24%) to trade at 23,588.25.

Top Movers

Sensex:

Of the 30 Sensex shares, 21 had been trading in the inexperienced. Losses were led through Adani Ports (-0.64%), accompanied by Axis Bank, Kotak Mahindra Bank, ICICI Bank, and UltraTech Cement.

Gains were dominated with the aid of Sun Pharma (+0.72%), with assistance from Asian Paints, Infosys, TCS, and Larsen & Toubro.

Nifty50:

On the wider Nifty50, 28 stocks traded lower. Declines were led via Bajaj Auto (-1.83%), JSW Steel, Trent, Eicher Motors, and Adani Ports & SEZ.

Advancers covered Adani Enterprises (+0.97%), accompanied by the aid of Apollo Hospitals, Asian Paints, Sun Pharma, and Britannia Industries.

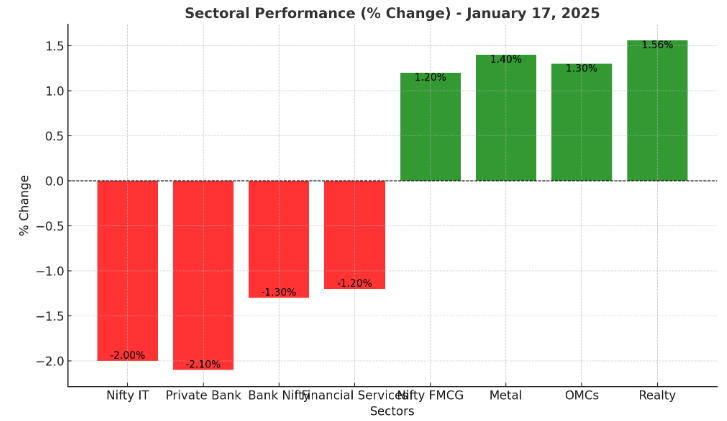

Sectoral Performance

Financial region indices registered declines, including Nifty Bank (-0.30%), Financial Services, Private Banks, and PSU Banks. Other sectors beneath strain protected Auto, Metal, Realty, Consumer Durables, and Oil & Gas.

On the advantageous facet, the Media index emerged because of the pinnacle gainer, advancing 0.93%, as observed by profits in IT, healthcare, FMCG, and pharma.

Broader Markets

The broader marketplace indices finished exceptionally higher, with the Nifty Smallcap 100 rising by way of 0.22% and the Nifty Midcap 100 edging up through 0.05%.

Year in Review & Outlook

Despite the recent pullback, each Sensex and Nifty50 introduced over 8% returns in 2024. However, slowing intake, subdued corporate income, and slow government and private capital expenditure have raised worries for 2025. Investors are keenly watching for increase-driven measures from corporate India and the government.

The near-time period marketplace sentiment remains cautious amid international dangers and uncertainties. With 1/3-sector earnings season starting next week, markets are searching ahead to a clearer picture of future growth potentialities.

Holiday Impact

Trading activity is expected to remain muted these days, with international markets in nations which include Australia, Japan, South Korea, Hong Kong, the UK, Europe, and the US closed for the New Year vacation.

Disclaimer

The statistics furnished in this news article are for informational features and must no longer be construed as economic recommendations. The inventory marketplace is concerned with dangers, and overall performance does not assure destiny outcomes. Conduct thorough studies and search for advice from an authorized financial advertising representative before making any investment selections.

+ There are no comments

Add yours