Indian benchmark indices BSE Sensex and Nifty50 traded higher on Tuesday, supported by mixed global cues.

Sensex climbs 250 pts to 76,550; Nifty at 23,170; BSE Mid, Smallcap up 1%

Market Overview at Midday

The BSE Sensex rose by 315.36 points (0.41%) to 76,645.37, while the Nifty50 climbed 105.20 points (0.46%) to 23,191.

Among Sensex constituents, 22 out of 30 stocks recorded gains. Zomato led the charge with a 3.50% increase, followed by strong performances from Tata Motors, IndusInd Bank, NTPC, and Adani Ports & SEZ. On the downside, HCLTech was the biggest laggard, shedding 9.35%, followed by declines in Tech Mahindra, Infosys, TCS, and Hindustan Unilever.

For Nifty50, 35 stocks advanced, with Adani Enterprises topping the list with a 3.51% gain. Other top performers included Tata Motors, IndusInd Bank, NTPC, and Adani Ports. However, IT heavyweights such as HCLTech (-9.34%), Tech Mahindra, Wipro, Infosys, and TCS were among the notable losers.

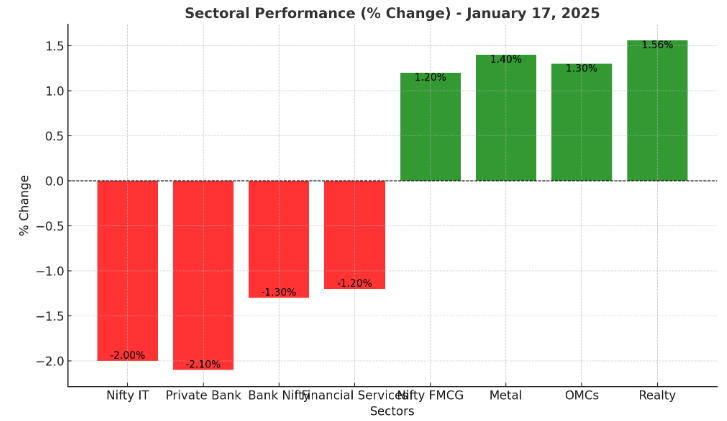

Sectoral Performance

The IT sector faced steep losses, declining 2.11%, followed by a 0.50% drop in the FMCG index.

On the other hand, the Metal index emerged as the top performer, surging 2.75%, while the PSU Bank index gained 2.26%.

Other sectors, including Auto, Bank, Financial Services, Media, Private Bank, and Oil, also recorded gains exceeding 1% each.

Broader Market Gains

The broader market indices also showed strength:

The Nifty Midcap 100 advanced 1.48%.

The Nifty Smallcap 100 gained 0.98%.

Global Market Sentiment

Despite lingering concerns over sticky inflation and the likelihood of a delayed rate-easing cycle by the US Federal Reserve, Wall Street closed on a mixed note. A robust US economy, coupled with rising dollar strength and Treasury yields, continued to weigh on global sentiment.

Disclaimer:

The records furnished in this article are for informational functions and do not represent financial or investment recommendations. Market investments are a problem with risks, which include a lack of fundamentals. Please talk with a certified economic consultant earlier than making any funding choices. Neither the writer nor the platform is liable for any losses incurred based on the facts offered.

+ There are no comments

Add yours