Indian equity benchmarks BSE Sensex and Nifty50 were trading higher on Thursday morning, bolstered by positive global cues.

The BSE Sensex was up by 303.55 points (0.40%) at 77,027.63, while the Nifty50 advanced 107 points (0.46%) to reach 23,320.30.

Market Movers

Post the opening bell, gains outnumbered losses across the board. Leading the gainers were:

- Zomato (+4.65%)

Adani Ports & SEZ

SBI

UltraTech Cement

IndusInd Bank

On the losing side, only six stocks traded in the red, including:

- Hindustan Unilever (-0.68%)

Nestle India

Sun Pharma

ITC

Bharti Airtel

Mahindra & Mahindra

On the Nifty50, 34 stocks registered gains, led by:

- HDFC Life (+9.39%)

Adani Enterprises

SBI Life

Adani Ports & SEZ

SBI

The laggards on Nifty50 included:

- Hindustan Unilever (-0.97%)

Tata Consumer Products

Nestle India

ITC

Cipla

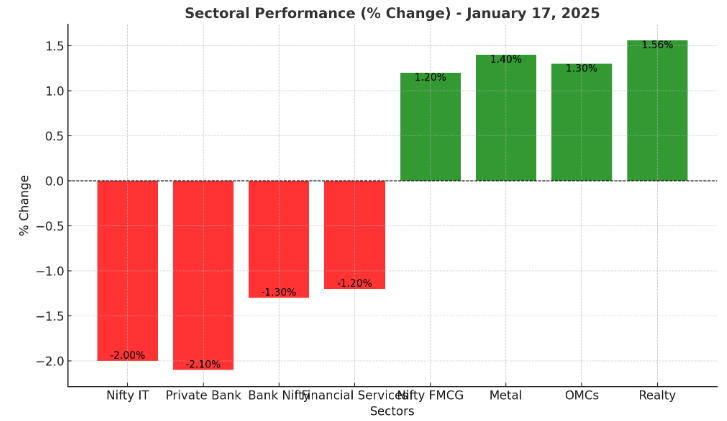

Sectoral Performance

The PSU Bank index was the top performer among sectoral indices, rising 2.46%. Other notable gainers included:

- Nifty Bank (+1.10%)

Financial Services Index (+1.15%)

Media, Metal, and Realty indices (up more than 1% each)

IT, Auto, Private Bank, Consumer Durables, and Energy indices

Conversely, the FMCG and Pharma indices were down by 0.24% and 0.14%, respectively, while the Healthcare index remained flat.

Broader Market Overview

The broader market also witnessed significant momentum, with the Nifty Midcap 100 gaining 1.50% and the Nifty Smallcap 100 climbing 1.55%.

Global Cues

Global markets provided a positive backdrop for the Indian indices. Wall Street surged overnight, driven by lower-than-expected core inflation figures, fueling optimism for at least two rate cuts by the Federal Reserve in 2025. Strong quarterly results from major banks like JPMorgan and Goldman Sachs also added to the rally.

Asian markets followed Wall Street’s lead, trading higher in response to the robust performance of U.S. equities.

Disclaimer:

The records furnished in this article are for informational functions and do not represent financial or investment recommendations. Market investments are a problem with risks, which include a lack of fundamentals. Please talk with a certified economic consultant earlier than making any funding choices. Neither the writer nor the platform is liable for any losses incurred based on the facts offered.

+ There are no comments

Add yours