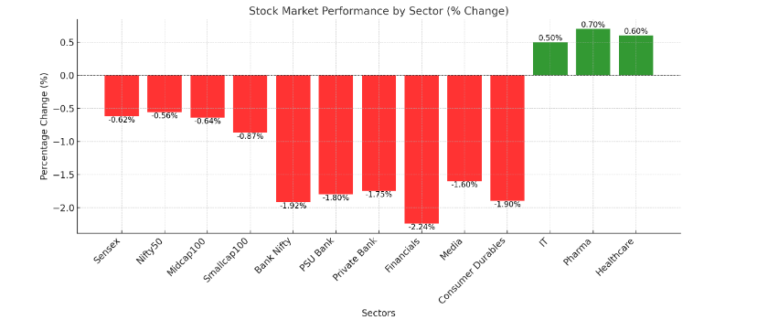

Indian benchmark indices, the BSE Sensex and Nifty 50, sharply decreased on Thursday, mirroring the decline on Wall Street following the US Federal Reserve’s hawkish observation.

At the hole bell, the BSE Sensex plunged 719.73 factors, or 0.90%, to 79,462.47, whilst the Nifty 50 dropped 213.10 points, or 0.88%, to 23,985.75.

The US Federal Reserve introduced a widely anticipated 25 basis points (bps) reduction to its benchmark price range goal price, putting the range at 4.25%-4.50%. However, the Fed’s hawkish tone regarding a slower pace of policy easing in 2025 brought about a good-sized promote-off in Wall Street’s predominant indices, a sentiment now spilling over to Indian markets.

Adding to the strain on Indian equities is the continuing promoting spree by way of foreign portfolio traders (FPIs), who’re redirecting finances to greater lucrative markets globally.

Despite the bearish sentiment, India’s number one market is buzzing with hobbies today. Five mainline IPOs are established for subscription: DAM Capital Advisors, Transrail Lighting, Concord Enviro Systems, Sanathan Textiles, and Mamata Machinery. The New Malayalam Steel IPO in the SME section is also opening for bids.

Key IPO-associated activities for the day include:

- Inventors Knowledge Solutions IPO (mainline) and Yash Highvoltage IPO (SME) making their market debut.

- NACDAC Infrastructure IPO (SME) closing its subscription window.

- Identical Brains Studios IPO (SME) getting into its 2d day of bidding.

Disclaimer

The statistics furnished in this news article are for informational features and must no longer be construed as economic recommendations. The inventory marketplace is concerned with dangers, and overall performance does not assure destiny outcomes. Conduct thorough studies and search for advice from an authorized financial advertising representative before making any investment selections.

+ There are no comments

Add yours