Indian benchmark equity indices, the BSE Sensex and Nifty50, traded lower on Friday, weighed down by subdued global cues.

Market Performance at Midday

The BSE Sensex turned down with the aid of 546.63 points (0.71%) at 76,496.19, at the same time as the Nifty50 declined by way of 143.20 points (0.61%) to 23,168.60.

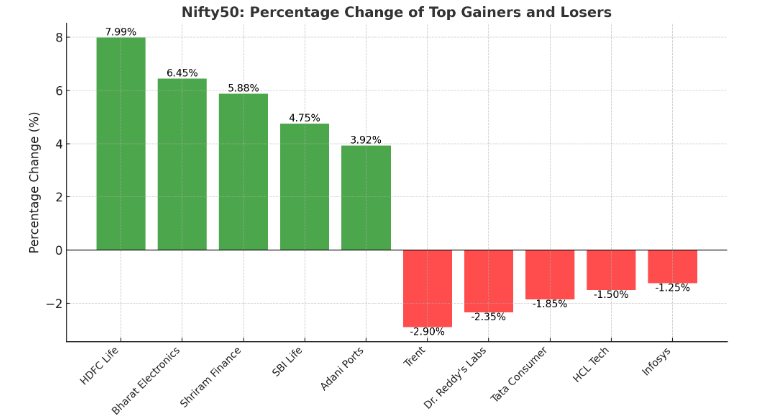

Top Movers on Sensex and Nifty50

On the 30-inventory BSE Sensex, 9 stocks traded in the green. Reliance Industries led the gainers, growing 2.03%, accompanied by Sun Pharma, Nestle India, Larsen & Toubro, and ITC. On the drawback, Infosys posted the steepest decline, falling 4.49%, trailed using Axis Bank, HCLTech, TCS, and Mahindra & Mahindra.

On the Nifty50, 31 stocks have been inside the pink. Infosys became the biggest laggard, down 4.50%, observed using Axis Bank, Mahindra & Mahindra, Trent, and Wipro. Gains were led via Reliance Industries, which surged 2.68%, accompanied by Hindalco Industries, Tata Consumer Products, HDFC Life, and Coal India.

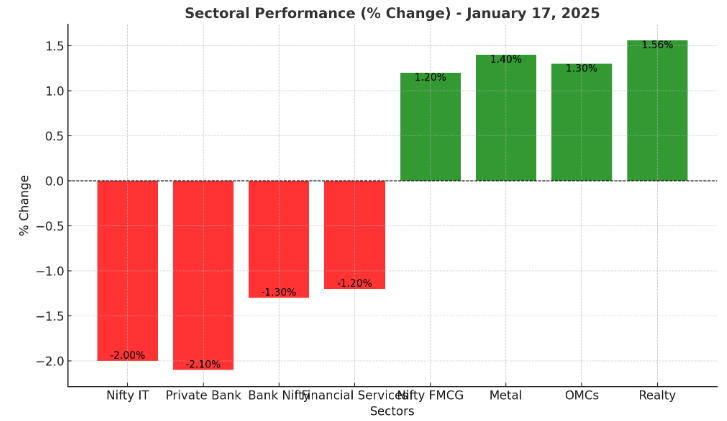

Sectoral Indices Overview

Most sectoral indices pondered a bearish fashion.

The Nifty IT index turned into the worst performer, dropping 2.31%.

The Private Bank index fell 1.44%, followed through declines inside the Nifty Bank (-0.95%) and Financial Services (-0.93%) indices.

Other lagging sectors protected Auto, Pharma, PSU Bank, Healthcare, and Consumer Durables.

On the high-quality aspect:

The Energy index won 1.28%.

The Realty and Metal indices additionally confirmed electricity, each advancing 0.47%.

Broader Market Trends

Broader markets were also under pressure:

The Nifty Smallcap100 fell through 0.20%.

The Nifty Midcap one hundred slipped 0.17%.

Global Cues and Macroeconomic Context

A brief rally on Wall Street on Wednesday turned into short-lived, as blended macroeconomic statistics weighed on sentiment Thursday. Strong December retail income and in-line jobless claims information highlighted resilience in the U.S. Economy. However, investor cognizance remained on the approaching inauguration of President-elect Donald Trump and the prospects of destiny Federal Reserve charge cuts.

This combined global sentiment contributed to the careful tone in Indian markets.

Disclaimer:

The records furnished in this article are for informational functions and do not represent financial or investment recommendations. Market investments are a problem with risks, which include a lack of fundamentals. Please talk with a certified economic consultant earlier than making any funding choices. Neither the writer nor the platform is liable for any losses incurred based on the facts offered.

+ There are no comments

Add yours