Mumbai, India, July 30, 2024: Quess Corp, India’s leading business services provider, announced its Q1FY25 financial results today.

Q1 FY25 Highlights

- Robust headcount growth of 14% YoY, now at 597,000+ employees

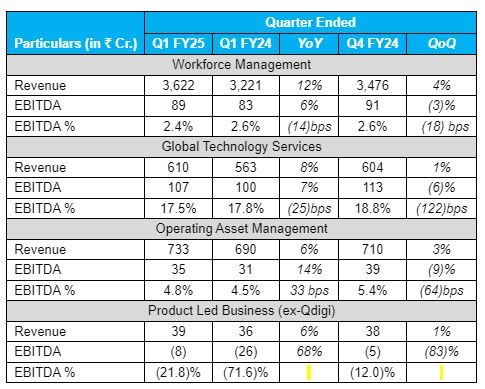

- Revenue at ₹5,003 cr, up by 9% YoY and 2% QoQ

- Quarterly EBITDA at ₹184 cr, up by 19% YoY and down 6% QoQ

- PAT at ₹112 cr, up by 132% YoY and 14% on a QoQ basis

Q1, historically, is a seasonally weak quarter for the company. Despite that, the company has grown revenues by 9% and EBITDA by 19% on a YoY basis. For the first time, Quess has crossed the milestone of ₹5,000 cr in quarterly revenue and a headcount of over 597,000. The EPS has also grown significantly by 116% on a YoY basis and 10% on a QoQ basis to ₹6.9 per share.

Commenting on the results, ED & Group CEO Mr. Guruprasad Srinivasan said: “In the first quarter of the year, we delivered a robust performance. The organization strengthening and optimization of operational efficiencies that Quess has undertaken over the last few quarters has shown results, and we expect this trend to continue. Also, the government’s focus on jobs will create a beneficial external environment for Quess and our demonstrated execution skills should help us leverage the opportunity that is now opening up.”

Q1FY25 Platform highlights

Workforce Management:

Associate headcount for the vertical is 485k, with an addition of 27k during the quarter, a 20% YoY growth

91 new contracts were added with an ACV of ₹514 cr

- Global Technology Solutions:

42 new logos were added with an ACV of ₹83 cr

CLM revenue growth of 20% YoY and 7% QoQ driven by the prominence of international mix in Allsec business

- Operating Asset Management:

27 new logos added with an ACV of ₹69 cr

EBITDA margin at 4.8% down 64 bps QoQ due to seasonality in margin accretive businesses such as F&B and Telecom Infra

Product Led Business:

Found its business has significantly reduced its cash burn and registered a growth of 7% YoY

+ There are no comments

Add yours