On Thursday, Indian benchmark indices, the BSE Sensex and NSE Nifty, noticed an enormous pullback, with both indices finishing over 1% lower as buyers braced for the U.S. Federal Reserve’s forthcoming financial coverage charge decision. The decline comes amid broader market uncertainty, as Fed Chair Jerome Powell prepares to address the general public for the primary time considering reports indicated former President Donald Trump won the 47th U.S. Presidential election.

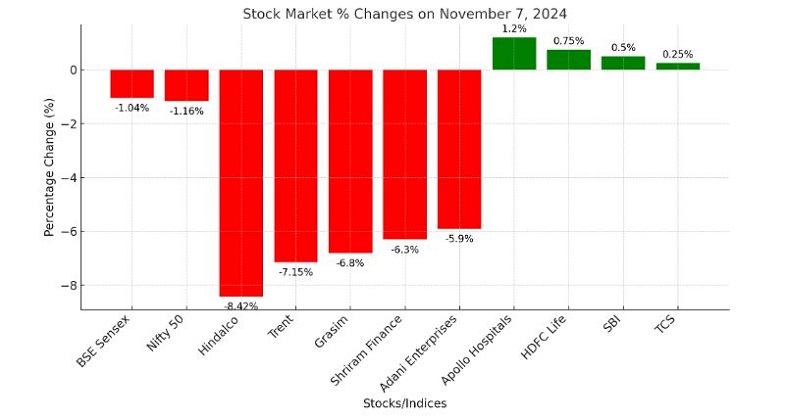

At the marketplace near, the BSE Sensex had fallen by 836.34 factors, or 1.04%, to settle at 79,541.79. Similarly, the Nifty 50 index declined by using 284.67 factors, or 1.16%, finishing the session at 24,199.35. The retreat underscores investor caution, with global markets relatively aware of any modifications in the Fed’s coverage stance that might affect hobby prices and, eventually, the funding landscape worldwide.

The bears took company management over D-Street, with 46 of the 50 constituent stocks within the Nifty50 finishing in poor territory. The biggest laggards of the day protected Hindalco, Trent, Grasim, Shriram Finance, and Adani Enterprises, which noticed declines extending up to 8.42%. The market sentiment turned into actually threat-averse, probably encouraged by the aid of worldwide and home economic worries. The looming price selection from the Federal Reserve introduced the stress, as higher U.S. Hobby quotes could lead to capital outflows from emerging markets, which includes India, affecting equity valuations negatively.

On the high-quality aspect, four shares in the Nifty50 managed to defy the broader trend and closed inside the green. These have been Apollo Hospitals, HDFC Life, State Bank of India (SBI), and Tata Consultancy Services (TCS). Their relative strength on a difficult buying and selling day indicates investor confidence in their enterprise basics and capacity for resilience even amid heightened volatility.

Overall, Thursday’s marketplace performance highlights the careful sentiment beforehand of key macroeconomic bulletins. As investors anticipate clarity on the Fed’s price selection, the Indian markets may additionally hold to experience short-term volatility. The Federal Reserve’s outlook ought to substantially affect global liquidity, influencing capital flows and the hazard urge for food of buyers in Indian equities within the near period.

Look out for Business News For Profit’s marketplace watch reports for a deeper dive and professional perspectives on the market’s nation. In the inventory marketplace’s ever-evolving panorama, our commitment to imparting correct and timely statistics will preserve to guide traders in making informed decisions.

Disclaimer

The records supplied in this article are for informational functions and have to now not be construed as financial advice. The stock marketplace is subject to risks, and past performance does now not assure destiny consequences. Always behavior thorough studies and consult with a qualified financial marketing consultant earlier than making any funding selections.

+ There are no comments

Add yours