The Indian benchmark indices, BSE Sensex and Nifty 50, made a sturdy comeback in the afternoon session on Tuesday, convalescing some of the losses incurred on Monday. This rebound comes just hours earlier than the anticipated results of the US presidential election and ahead of the United States Federal Reserve coverage assembly later within the week.

Market analysts attributed the recovery to a technical bounceback and short-covering, which lifted investor sentiment and helped the indices close in superb territory.

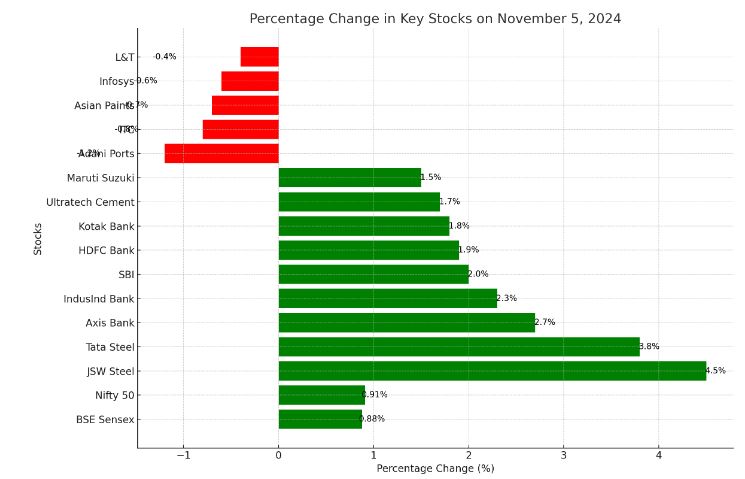

The BSE Sensex gained 694 factors or 0.88%, settling at 79,476.63, whilst the Nifty 50 closed above the 24,200 mark at 24,213, up by way of 218 factors or 0.91%.

Top Gainers and Sectoral Performance

The rebound changed into led with the aid of strong performances in steel and banking stocks. Key stocks driving the restoration blanketed JSW Steel, Tata Steel, Axis Bank, IndusInd Bank, SBI, HDFC Bank, Kotak Bank, Ultratech Cement, and Maruti Suzuki, all of which rallied between 1.5% and 4.7% on the Sensex.

In the wider marketplace, BSE MidCap and BSE SmallCap indices saw gains as well, every edging up through 0.4%.

Sector-Wise Gains and Declines

The Nifty Metal index recorded the maximum tremendous profits, growing by almost 3% on the return of robust buying in metallic and metal stocks. The Nifty Private Bank and Bank indices additionally accomplished properly, each up through around 2%.

However, not all sectors saw high-quality motion. The Nifty FMCG and IT indices barely decreased, declining up to 0.3% as traders became careful in these sectors.

Limited Losses in Key Stocks

While most of the 30 stocks within the Sensex gained, nine shares ended inside the red, which includes Adani Ports, ITC, Asian Paints, Infosys, and L&T, with declines capped at around 1.5%.

The restoration in the Indian stock markets highlights a carefully positive sentiment amongst investors, who are eyeing major global occasions, consisting of the American presidential election and the Fed’s coverage outlook. As the week progresses, the marketplace will in all likelihood react to worldwide developments, with a close watch on the implications for hobby fees and trade regulations.

Look out for Business News For Profit’s marketplace watch reports for a deeper dive and professional perspectives on the market’s nation. In the inventory marketplace’s ever-evolving panorama, our commitment to imparting correct and timely statistics will preserve to guide traders in making informed decisions.

Disclaimer

The records supplied in this article are for informational functions and have to now not be construed as financial advice. The stock marketplace is subject to risks, and past performance does now not assure destiny consequences. Always behavior thorough studies and consult with a qualified financial marketing consultant earlier than making any funding selections.

+ There are no comments

Add yours