Stock Market Highlights: Sensex and Nifty End the Week on a Positive Note

Indian fairness markets wrapped up the final buying and selling session of the week on high notice, getting better from early losses to shut within the inexperienced. The BSE Sensex surged by 843.16 factors or 1.04%, finishing at 82,133.12. Throughout the day, the index oscillated between an excessive of 82,192.61 and a low of 80,082.82

The Nifty 50 additionally published profits, rising 219.60 factors or 0.89% to close at 24,768.30. The index hit an intraday high of 24,792.30, at the same time as the day’s low stood at 24,180.80.

Market Movers

The day ended firmly in the choice of the bulls, with 41 out of 50 Nifty shares ultimately inside the inexperienced. Top gainers covered:

Bharti Airtel

ITC

Kotak Mahindra Bank

Hindustan Unilever

UltraTech Cement

These stocks registered gains of up to 4.44%.

On the flip facet, 9 shares ended within the red, led by using:

Shriram Finance

Tata Steel

Hindalco

IndusInd Bank

JSW Steel

Losses in these counters extended up to 2.44%.

Volatility Index

The market’s worry gauge, India VIX, which measures volatility, dipped by 1.04% to settle at thirteen.05, indicating an exceedingly calmer buying and selling consultation.

Broader Markets and Sectoral Performance

In the broader market, performance became muted:

Nifty Midcap a hundred edged lower through 0.05%

Nifty Smallcap a hundred fell through 0.30%

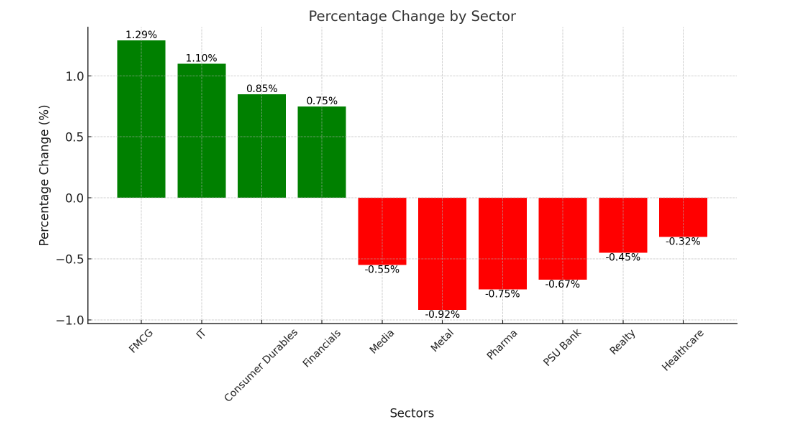

Sectoral indices showed a combined trend:

Gainers:

Nifty FMCG

IT

Consumer Durables

Financials

These sectors registered profits of up to at least 1.29%.

Losers:

Nifty Media

Metal

Pharma

PSU Bank

Realty

Healthcare

These indices ended the day within the purple.

Market Outlook

The markets showcased resilience by reversing early losses and ending on a nice word, supported with the aid of gains in FMCG, IT, and financial shares. However, the wider market’s subdued performance and mixed sectoral trends mirror cautious optimism.

Look out for Business News For Profit’s marketplace and watch critiques for a deeper dive and expert perspectives in the marketplace’s country. In the inventory market’s ever-evolving panorama, our commitment to providing accurate and well-timed information will maintain manual traders in making informed selections.

Disclaimer

The statistics furnished in this news article are for informational features and must no longer be construed as economic recommendations. The inventory marketplace is concerned with dangers, and beyond overall overall performance does not assure destiny outcomes. Always behavior thorough studies and are searching for advice from an authorized financial advertising representative earlier before making any investment selections.

+ There are no comments

Add yours