India’s Goods and Services Tax (GST) collections reached Rs 1,74,550 crore in December 2025, reflecting a 6.1% year-on-year growth. The surge underscores robust economic activity, higher consumer demand, and steady business operations across sectors, signaling resilience in both domestic markets and trade.

The growth in collections comes despite recent tax rate cuts, implemented in September 2025. The reduction has actually stimulated consumption, encouraging businesses to ramp up production and trade. December marked the seventh month this fiscal year with GST revenues exceeding Rs 1.60 lakh crore, indicating sustained economic momentum.

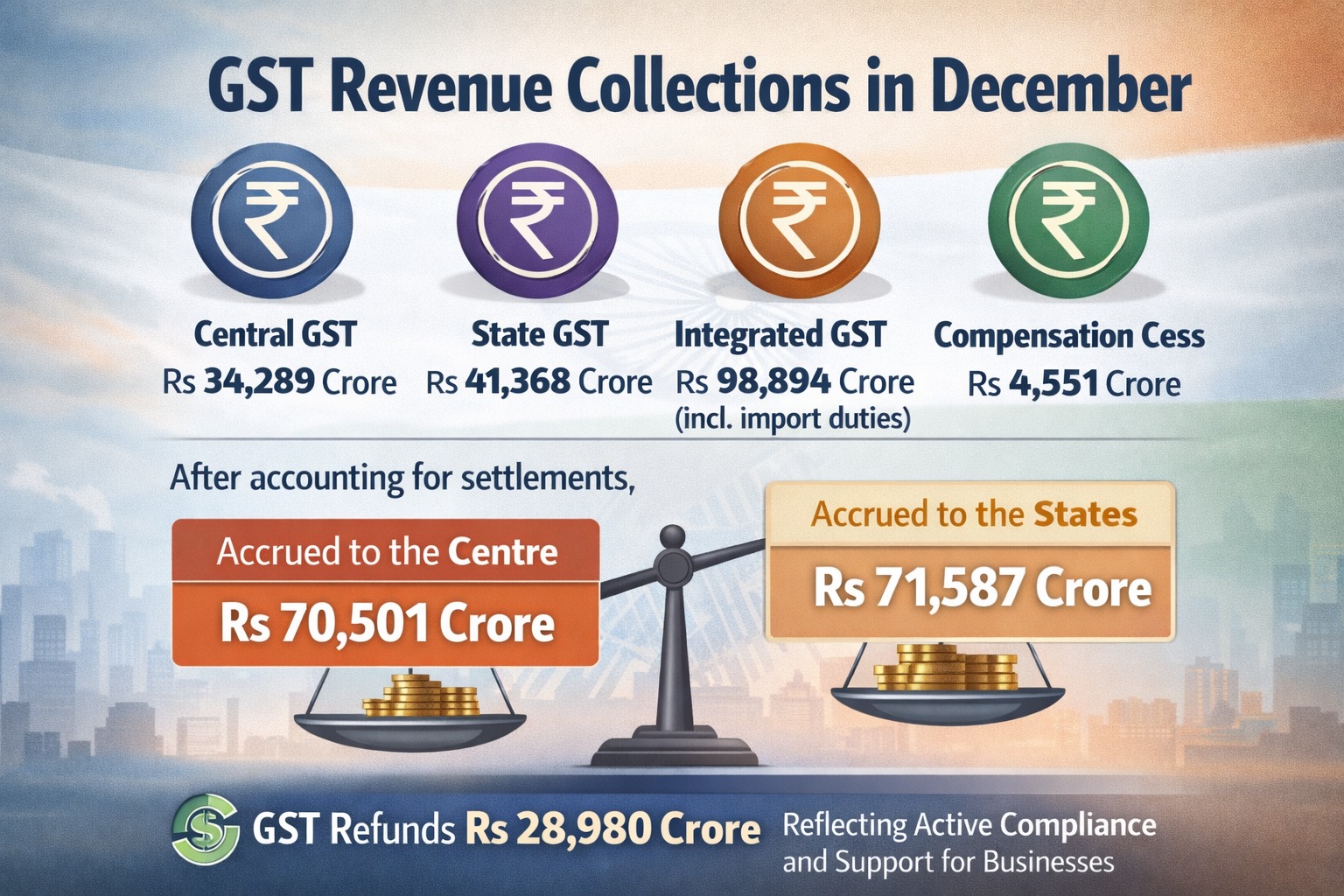

Key Components of GST Collections

In December, Central GST (CGST) collections were Rs 34,289 crore, State GST (SGST) Rs 41,368 crore, and Integrated GST (IGST) Rs 98,894 crore, including import duties. The GST compensation cess contributed Rs 4,551 crore, serving as a transitional mechanism until all loan and interest obligations are met.

After accounting for settlements, the total revenue accrued to the Centre and states reached Rs 70,501 crore (CGST) and Rs 71,587 crore (SGST). GST refunds totaled Rs 28,980 crore, highlighting active compliance and support for businesses in the export and domestic trade sectors.

GST Trends Reflect Business Resilience

From April to December 2025, cumulative GST collections amounted to Rs 14.97 lakh crore, marking a 12% increase over the previous year. Average monthly collections during this period stood at Rs 1.66 lakh crore, up from Rs 1.49 lakh crore in 2024–25, reflecting strong trade flows, industrial activity, and service sector growth.

Revenue from domestic transactions, including imported services, increased by 13% year-on-year, demonstrating stronger business engagement and expansion across industries. The rise in collections indicates growing production, higher consumption, and improved compliance among enterprises of all sizes.

Impact on Trade and Business Sectors

The sustained growth in GST collections provides a clear signal of vibrant trade activity. Higher collections support the smooth functioning of industries, enable better cash flow for businesses, and enhance the government’s ability to fund infrastructure and development projects that directly benefit commerce and logistics sectors.

The service and manufacturing sectors have particularly contributed to the increase, with higher demand for industrial goods, consumer products, and professional services driving revenue growth. Businesses, particularly MSMEs, benefit from a predictable tax environment, which encourages expansion into domestic and export markets.

Upcoming Tax Reforms

Effective February 1, 2026, new excise duty rates for tobacco products and updated provisions for pan masala taxation will be implemented. These adjustments aim to align indirect taxes with public health objectives while maintaining trade balance and revenue stability. For businesses in the FMCG and retail sectors, these reforms offer clarity and predictability in planning production, pricing, and distribution strategies.

Business Outlook

The GST growth reflects a healthy trade ecosystem, where increased consumption, active industrial output, and export activities are driving revenues. The stable inflow of indirect taxes provides businesses with confidence to invest, expand operations, and participate more actively in both domestic and global markets.

For sectors like manufacturing, logistics, retail, and services, strong GST collections are a positive indicator of demand-driven growth, encouraging investments in technology, workforce expansion, and supply chain enhancements. The government’s initiatives, coupled with a well-structured GST framework, are positioning India as a more competitive player in global trade.

As 2026 unfolds, GST collections will continue to act as a barometer of economic and business health, reflecting the pace of industrial activity, trade engagement, and market confidence. For businesses, the current trends highlight opportunities to leverage consumer demand, enhance operational efficiency, and expand their footprint across domestic and international markets.