India’s electric vehicle (EV) sector is entering a decisive phase. After several years of rapid expansion driven by subsidies, policy nudges, and rising fuel costs, the industry is now confronting a more complex reality—one that tests its ability to scale sustainably without heavy state support. The transition marks a shift from policy-led adoption to market-led consolidation.

Growth Story Still Intact, but Slowing at the Edges

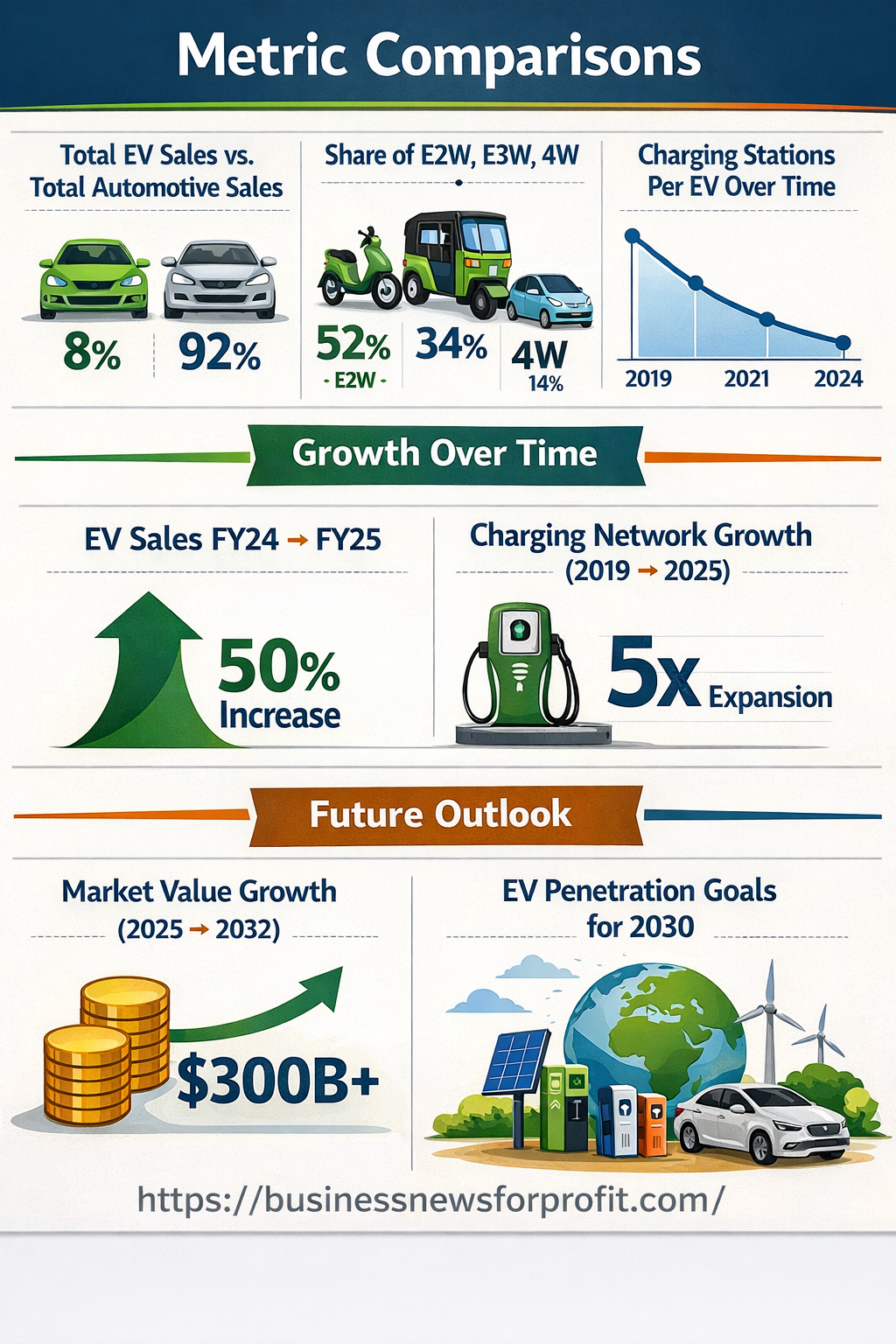

EV sales in India continue to rise, particularly in two-wheelers and three-wheelers, which together form the backbone of electric mobility adoption. These segments benefit from lower upfront costs, predictable daily usage, and faster breakeven periods—making them commercially viable even as incentives taper.

However, growth is no longer uniform. Passenger electric cars, while gaining visibility, remain a small fraction of overall vehicle sales. High acquisition costs, limited charging confidence, and cautious consumer sentiment have moderated momentum. This divergence suggests that India’s EV journey is not a single highway, but multiple lanes moving at different speeds.

Policy Reset Signals Confidence—and Caution

Recent policy signals indicate that the government believes certain EV segments can now stand on their own. The gradual withdrawal of direct subsidies, especially in commercial electric mobility, reflects confidence in cost competitiveness but also introduces near-term pressure on manufacturers operating on thin margins.

At the same time, the policy focus is shifting from sales incentives to ecosystem resilience—battery traceability, recycling norms, domestic manufacturing, and supply-chain security. This pivot is strategically important. India is attempting to avoid the pitfalls faced by other markets where EV growth outpaced infrastructure and sustainability planning.

Charging Infrastructure: The Strategic Bottleneck

Despite rising vehicle numbers, charging infrastructure remains the sector’s weakest link. Urban clusters have seen progress, but inter-city corridors, smaller towns, and residential charging solutions lag behind demand.

This gap disproportionately affects electric cars and fleet operators, reinforcing the dominance of two- and three-wheelers where home or depot charging is viable. Unless charging deployment accelerates—supported by utilities, real estate developers, and private investors—EV adoption risks plateauing beyond early adopters.

Battery Economics and Localisation Take Centre Stage

As subsidies recede, battery costs and supply chains are emerging as decisive factors. Manufacturers are under pressure to localise cell production, improve energy density, and extend battery life—all while keeping prices competitive.

India’s push for domestic battery manufacturing is as much an economic strategy as a geopolitical one. Reducing import dependence, especially on critical minerals, will shape the sector’s long-term stability. Success here could determine whether India becomes a global EV manufacturing hub or remains a consumption-led market.

Consumer Trust Is the New Currency

The next phase of EV growth will be driven less by incentives and more by consumer confidence. Issues such as real-world driving range, resale value, after-sales service, and battery warranties are increasingly influencing purchase decisions.

Early adopters were willing to experiment. Mass consumers are not. For EVs to break into the mainstream—particularly in the passenger vehicle segment—manufacturers must deliver reliability and transparency alongside innovation.

Sustainability Narrative Gains Weight

EVs are now firmly embedded in broader discussions around air quality, urban planning, and climate responsibility. Public discourse has shifted from whether EVs are needed to how quickly and responsibly they can be adopted.

This evolving narrative places additional responsibility on policymakers and industry players to ensure that electrification does not merely shift emissions upstream but genuinely contributes to cleaner mobility through renewable energy integration and responsible battery disposal.

What Lies Ahead

India’s EV sector is no longer in its infancy—it is entering adolescence. The easy gains from subsidies and early enthusiasm are giving way to tougher questions around infrastructure, affordability, and scale.

The next two to three years will likely define the industry’s trajectory:

-

Consolidation among manufacturers

-

Greater private investment in charging and batteries

-

Sharper focus on the total cost of ownership

-

Selective but strategic policy support

Bottom line: India’s EV revolution is real, but its success will now depend less on government push and more on market pull. The shift from acceleration to stability will test the sector’s resilience—and determine whether electric mobility becomes a niche solution or a national norm.