26 Oct 2024 Indian fairness markets endured their dropping streak this week, with each of the Sensex and Nifty logging their fourth consecutive weekly decline. Weak profits reports, worldwide economic uncertainty, and intensified foreign selling led the Sensex to close under the considerable 80,000 mark for the first time when you considering mid-August.

Weekly Market Performance

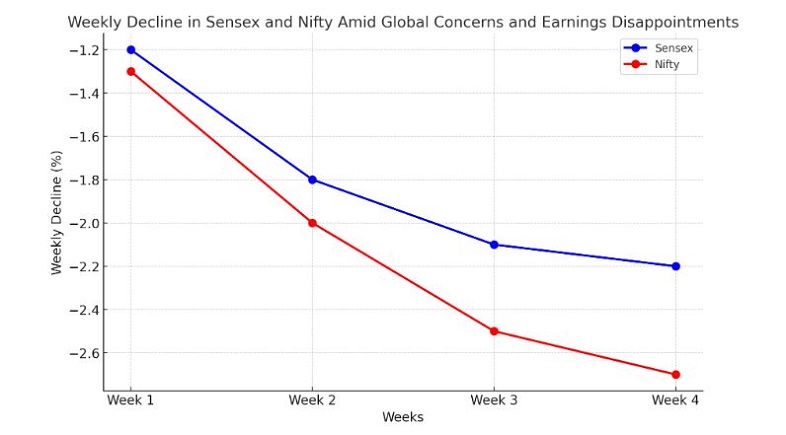

The Sensex and Nifty saw weekly declines of 2.2% and a couple of.7%, respectively, with both indices down nearly 8% from recent highs. Disappointing profit reviews from key sectors brought to the bearish mood, casting doubts over close-to-term boom prospects. Mid and small-cap indices were additionally hit, with the Nifty Midcap 100 and Smallcap 100 losing by using 1.9% and a couple of.2%, respectively, reflecting a broader market weak spot.

Foreign Investors Exit, Pressuring Market Sentiment

Foreign portfolio buyers (FPIs) have elevated their sell-off of Indian shares amid ongoing global concerns. October alone saw net FPI outflows reaching Rs 85,790 crore, driven via susceptible earnings and appealing possibilities in other markets, including China, where the authority’s stimulus has spurred hobby. The massive-scale outflows have weighed closely on marketplace sentiment, impacting both huge and small buyers.

Growing Volatility and Broader Uncertainty

Volatility has elevated notably, with the India VIX rising via four.7% to 14.6 this week, indicating heightened warning inside the market. A loss of clarity on U.S. Rate policy and geopolitical uncertainties has brought a threat-off sentiment, pushing many buyers toward safer properties.

Looking Ahead

Market analysts are reducing their profit expectations for FY25, and some advise that zero or very modest growth will be on the horizon if monetary situations don’t stabilize soon. As Indian markets navigate ongoing headwinds, investor sentiment might also continue to be careful in the coming weeks, mainly with key profits bulletins and geopolitical occasions still in play.

+ There are no comments

Add yours