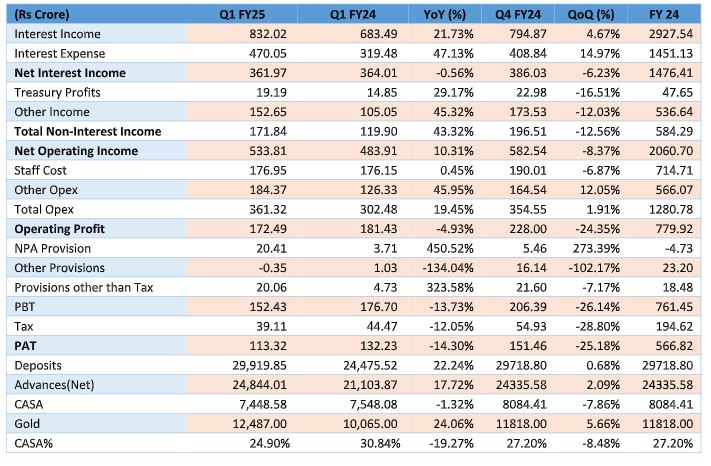

The Board of Directors of CSB Bank took on record the financial results for the quarter ended 30.06.2024 (Q1 FY 2025) which were subject to limited review in their meeting held on 29.07.2024

Highlights

a) Profit after Tax is at Rs 113.32 Cr in Q1 FY25 as against Rs 132.22 Cr in Q1 FY 24. We continue to maintain the accelerated provisioning policy during this quarter as well. Return on Assets and NIM were at 1.27% and 4.36% respectively during Q1FY25.

b) Operating Profit of the bank is at Rs 172.49 Cr as against Rs 181.43 Cr in Q1 FY 24.

c) Net Interest Income (NII) earned for the Q1 FY25 was Rs 361.97 Cr as against Rs 364.01 Cr in Q1 FY 24.

d) Non-interest income for Q1 FY25 is at Rs 171.83 Cr as against Rs 119.90 Cr for the same period last year up by 43%. While Treasury income grew by 29%, other incomes excluding treasury income increased by Rs 47.60Crs or by 45% on a YoY basis.

e) The income Ratio is at 67.69% at the end of Q1 FY 25; whereas it was 62.51% at the end of Q1 FY 24. The increase is mainly on account of significant investments made in people, distribution, systems & processes in the build phase aimed at creating a strong foundation for the scale that we aspire to achieve as part of SBS 2030

f) Asset Quality & Provisioning

GNPA and NNPA ratios increased by 42 bps and 36 bps respectively compared to Q1 FY24.

g) Robust Capital Structure – Capital Adequacy Ratio is at 23.61%, which is well above the regulatory requirement. CRAR as of 30.06.23 was 25.99%

h) Total Deposits grew by 22% YoY from Rs 24,475.52 Crs as of 30.06.23 to 29,919.85 Crs as of 30.06.24. The CASA ratio stood at 24.90% as of 30.06.2024

i) Advances (Net) grew by 18% YoY to Rs 24,844.01Crs as of 30.06.2024supported by a robust growth of 24% in gold loans on a YOY basis. Gold loan portfolio crossed the Rs 12,000 Cr mark

CEO Speak:

Speaking about the performance Mr. Pralay Mondal, Managing Director & CEO said, “In the quarter gone by, we were able to deliver a growth of 22% and 18% in our deposits and net advances respectively on a YoY basis. Our total income recorded a growth of 25% with a substantial contribution from the other income growth of 43% over Q1 FY 24. All the regulatory ratios like CRAR, LCR, etc are stable and robust. Despite the increased cost of funds and additional expenditure towards the build phase, we could register an operating and net profit of Rs 172 Cr and Rs 113 Cr respectively.

We are committed to achieving what we have envisioned in our SBS 2030 journey and have made significant strides here. On the distribution front, we have already opened 15 branches in Q1 and will continue with our expansion plans. On the technology front, project implementations are being tracked closely towards successful & timely execution. Our SBS vision is driving our strategic goals, thus ensuring sustained growth and value creation for all stakeholders”

+ There are no comments

Add yours