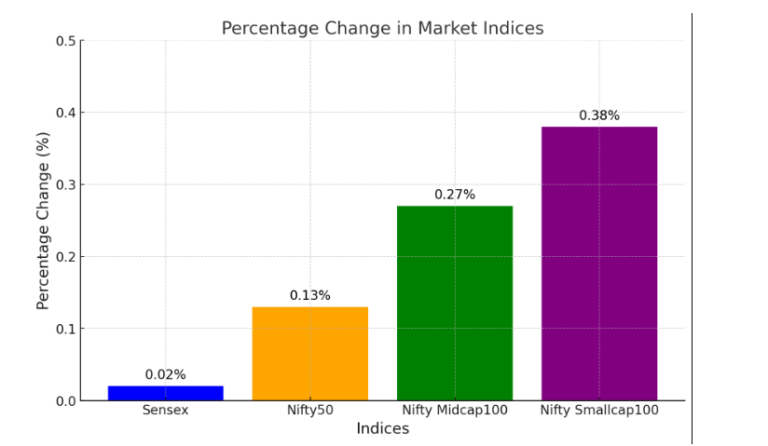

Benchmark equity indices opened on a consistent observe Friday after steep losses within the previous consultation. The BSE Sensex started 12 factors lower at 79,032 but quickly rebounded, climbing over 150 factors to reach the 79,200 range. Meanwhile, the NSE Nifty saw a gain of 50 points, trading close to 23,960.

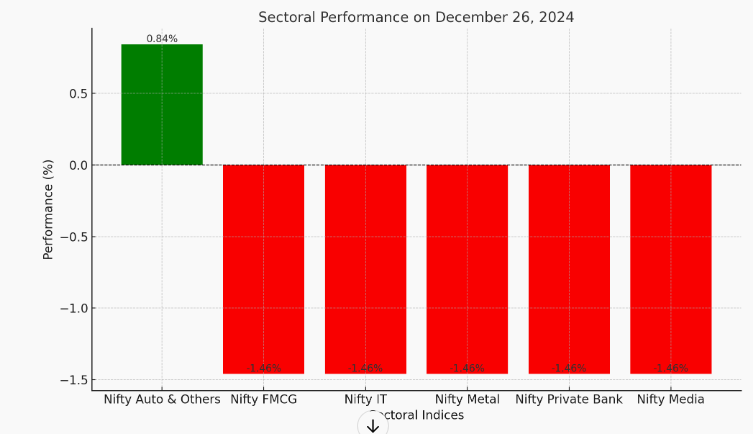

Investors’ cognizance nowadays will be on GDP figures and the performance of Asian markets. On Thursday, both the Sensex and Nifty declined by using up to at least one.5%, pushed by the monthly F&O expiry and concerns over Russia’s attacks on Ukraine’s electricity infrastructure.

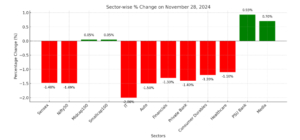

Market Sentiment and Foreign Flows

Foreign institutional investors (FIIs) resumed selling after days of net buying. Data from SEBI found out that FIIs offloaded shares worth ₹11,756.25 crore on November 28. On the other hand, home institutional investors (DIIs) have been net customers, buying shares worth ₹eight,718.30 crore.

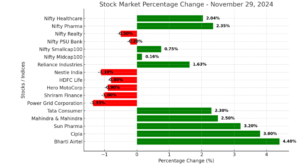

Stocks in Focus

Adani Group stocks can also see heightened interest after Abu Dhabi-primarily based International Holding Company (IHC) reaffirmed its confidence inside the conglomerate, retaining its positive investment outlook despite current US indictment expenses.

Shares of Adani Green, together with Angel One, BSE, Delhivery, DMart, Jio Financial Services, LIC India, Nykaa, Paytm, and Zomato, are set to draw interest as they start buying and selling within the futures & options (F&O) section these days.

Market Updates: Derivatives and Regulatory Changes

New Expiry Rules:

The BSE introduced that from January 1, 2025, the expiry day for its key derivatives contracts—Sensex, Bankex, and Sensex 50—will shift from Friday to Tuesday.

The November series contracts are set to expire today beneath the modern-day timetable.

Interoperability Implementation:

SEBI proposed the creation of interoperability throughout stock exchanges for segments like coins, derivatives, foreign money, and hobby charge derivatives beginning April 1, 2025.

IPO Highlights

Listings Today:

Enviro Infra Engineers IPO (Mainline) and Lamosaic India IPO (SME) debut on the exchanges nowadays.

Enviro Infra Engineers turned into trading at a top class of over 30% in the gray market as of Thursday.

Ongoing Subscriptions:

Investors can still enroll in IPOs of Suraksha Diagnostic (Mainline), Ganesh Infraworld (SME), Agarwal Toughened Glass India (SME), Abha Power and Steel (SME), and Apex Ecotech (SME).

Allotment News:

Rajputana Biodiesel IPO (SME) is set to finalize its allotment these days.

Asian Markets:

Japanese stocks declined, with the Nikkei down 0.7%, because the yen surged following robust inflation statistics from Tokyo. The center customer price index confirmed growth in November, staying above the Bank of Japan’s 2% target, elevating expectations of a price hike.

Other indices noticed combined effects:

Kospi: -1.7%

Taiwan and Hang Seng: -0.3%

Shanghai Composite: +0.2%

US Markets:

Wall Street changed into closed on Thursday for Thanksgiving, with a shortened trading consultation scheduled for that night.

Commodities:

Oil expenses edged higher because of heightened tensions inside the Middle East and delays inside the OPEC+ assembly to extend manufacturing cuts.

Disclaimer:

Investments in the stock marketplace are a problem of marketplace dangers. The above statistics are for instructional and informational purposes and have to not be taken into consideration as economic recommendations. Please seek advice from a certified financial advisor earlier than making any investment decisions.

+ There are no comments

Add yours