Indian fairness markets commenced the week on a high-quality word at some point in Monday’s pre-open session, buoyed by mixed global cues. The BSE Sensex rose 282 points (0.36%) to 77 s,862, whilst the Nifty 50 climbed 72 points (0.31%) to 23,605.

Market Sentiment

Investors remain cautious amid strengthening U.S. Financial records in advance of Donald Trump’s inauguration. Federal Reserve Chair Jerome Powell emphasized no urgency in decreasing interest costs, reflecting confidence in the ongoing financial boom and exerting market resilience regardless of inflation remaining above the 2% goal.

Closing Highlights of the Previous Week

On Friday, the BSE Sensex fell a hundred and 10.64 points (0.14%) to 77,580.31.

The Nifty 50 declined 26.35 points (0.Eleven%) to close at 23,532.70.

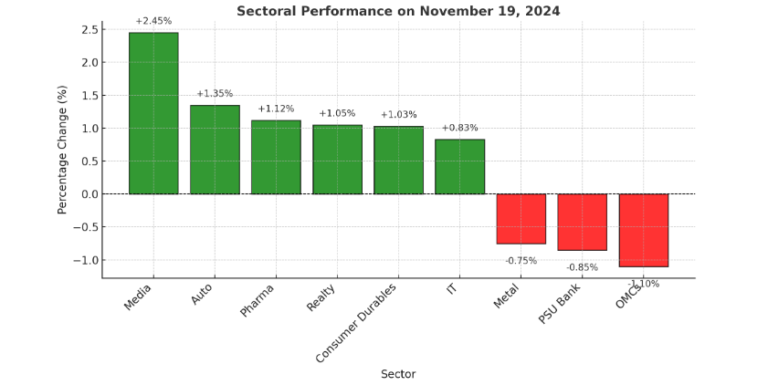

Broader markets outperformed, with the Nifty Smallcap a hundred growing 0.81% and the Nifty Midcap a hundred gaining 0.55%. Among sectors:

Gainers: Auto, Realty, Media, Healthcare, and Financials.

Losers: FMCG, PSU Banks, Pharma, and OMCs.

Consumption-associated stocks confronted stress due to growing inflation and decreased purchaser spending strength.

Mutual Fund Trends

Despite marketplace fluctuations, Flexicar and big-cap mutual fund categories noticed document inflows in October, signaling persisted investor interest.

Global Markets

Asian markets traded higher on Monday morning:

South Korea’s Kospi: Up 2.24%.

Kosdaq: Gained 1.38%.

Japan’s Nikkei 225: Down 0.78%; Topix fell 0.52%.

Australia’s S&P/ASX 2 hundred: Near flatline with a slight high quality bias.

Hong Kong’s Hang Seng: Gained 1.8%.

China’s CSI 300: Rose 0.29%; Shanghai Composite elevated 1.44%.

Last week, international equities noticed their largest weekly drop in two months. The MSCI World Index fell 1% and is down 2.4% for the week.

U.S. Market Insights

On Friday:

Dow Jones fell 305.87 factors (0.70%) to 43,444.99.

S&P 500 declined 78.55 points (1.32%) to 5,870.62.

Nasdaq Composite dropped 427.53 factors (2.24%) to 18,680.12.

For the week, the S&P 500 fell 2.08%, the Nasdaq dropped 3.15%, and the Dow shed 1.24%.

Economic records confirmed robust retail income, growing 0.4% in October, surpassing expectancies. However, import fees all of sudden rose 0.3% because of higher gasoline charges.

Bond and Currency Markets

U.S. 10-12 months Treasury yields reached a 5-and-a-1/2-month high of 4.505% on Friday earlier than settling at four.439%, marking the 8th weekly rise in nine weeks. The dollar index dipped zero.12% to 106.75.

Expectations for a 25-foundation-point Fed fee reduction in December fell to 58.4% (down from 85.5% a month in the past).

Crude Oil Prices

Oil fees weakened amid lower Chinese demand and slower Fed fee-cut projections:

U.S. Crude: Down 2.45% to $67.02/barrel.

Brent Crude: Fell 2.09% to $71.04/barrel.

European Markets

The STOXX six hundred Index dropped 0.77% on Friday but posted a minor weekly advantage, its first in 4 weeks.

Outlook

Markets will intently screen global financial indicators and principal bank signals for similar policy routes, particularly concerning inflation and increased worries.

+ There are no comments

Add yours