By Sujata muguda

The benchmark fairness indices, BSE Sensex and NSE Nifty50, started the week on a tremendous note, lasting over 1% higher on Monday. The markets drew electricity from the landslide victory of the Bharatiya Janata Party (BJP)-led coalition inside the Maharashtra Assembly elections and robust international cues.

Key Index Performances

BSE Sensex:

The Sensex surged 1,961.32 points, or 2.54%, to close at eighty,109.85, after hitting an intraday high of eighty,473.08.

NSE Nifty50:

The Nifty50 advanced 314.65 factors, or 1.32%, to settle at 24,221.90, having touched an intraday excessive of 24,351.55.

Market Breadth and Movers

Nifty50 Performers:

The session ended strongly for the bulls, with 47 out of fifty stocks within the index remaining inside the inexperienced. Top gainers blanketed ONGC, BEL, BPCL, and Shriram Finance, which published gains of as much as 5.48%.

Nifty50 Laggards:

On the flip aspect, JSW Steel, Tech Mahindra, Infosys, Maruti Suzuki India, and Bajaj Auto were some of the 19 shares that ended lower, with losses of up to 2.32%.

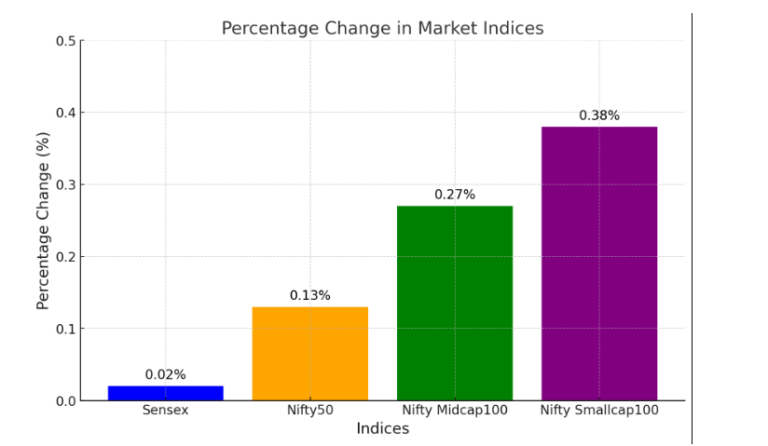

Broader Markets

- The Nifty Smallcap100 index rose 2.03%, outperforming different segments.

- The Nifty Midcap100 index won 1.61%, reflecting robust investor sentiment in broader markets.

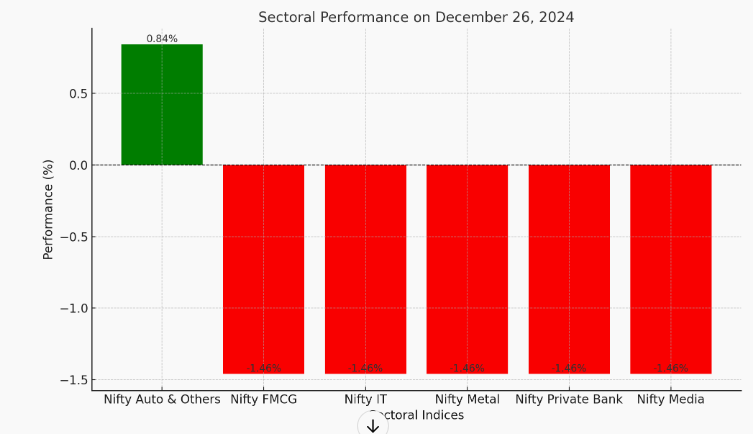

Sectoral Indices

All sectoral indices closed in fine territory:

- Nifty PSU Bank index led the profits, surging 4.16%.

- Bank Nifty, Realty, and OMC indices each superior with the aid of over 2%.

- Sectors like Financial Services, Media, Private Banks, and Consumer Durables also ended better, posting gains of over 1%.

The strong performance on Monday signals investor optimism strengthened through domestic political stability and favorable global marketplace trends. However, marketplace watchers stay careful approximately worldwide uncertainties and their ability to affect upcoming sessions.

Look out for Business News For Profit’s marketplace and watch critiques for a deeper dive and expert perspectives in the marketplace’s country. In the inventory market’s ever-evolving panorama, our commitment to providing accurate and well-timed information will maintain manual traders in making informed selections.

Disclaimer

The statistics furnished in this newsletter are for informational features and must no longer be construed as economic recommendations. The inventory marketplace is concerned with dangers, and beyond overall overall performance does not assure destiny outcomes. Always behavior thorough studies and are searching for advice from an authorized financial advertising representative earlier before making any investment selections.

+ There are no comments

Add yours