Indian equity markets closed the week on a sturdy be aware, with each of the BSE Sensex and NSE Nifty50 surging over 2% every, pushed by huge-primarily based buying across sectors.

Benchmark Indices Soar

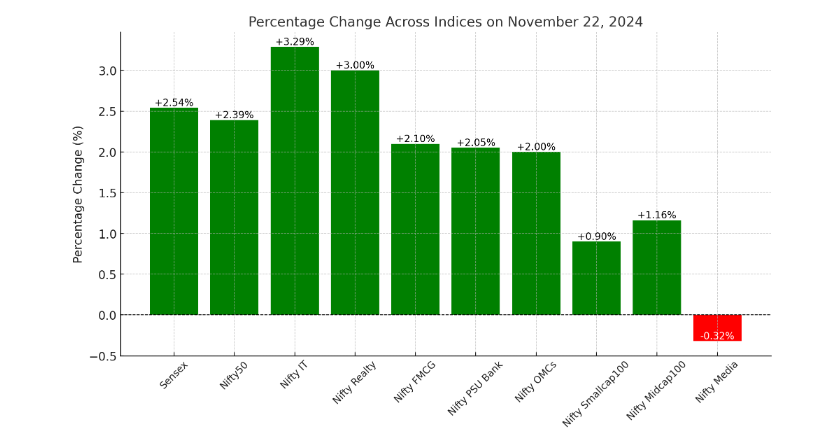

The BSE Sensex jumped 1,961.32 points (2.54%) to settle at 79,117.11, after achieving an intraday high of 79,218.19.

The NSE Nifty50 climbed 557.35 points (2.39%) to shut at 23,907.25, with an intraday peak of 23,956.10.

Market Performance

Nifty50 Highlights:

Out of the 50 stocks on the index, 49 ended within the inexperienced, showcasing sturdy bullish momentum. Top gainers protected State Bank of India, Titan Company, Tata Consultancy Services, Ultratech Cement, and HCL Tech.

Bajaj Auto changed into the sole laggard, finishing the consultation within the red.

Broader Markets:

The Nifty Smallcap100 rose 0.90%, at the same time as the Nifty Midcap100 received 1.16%, reflecting positive sentiment in mid- and small-cap shares.

Sectoral Indices Performance

Most sectoral indices ended better, barring the Nifty Media Index, which slipped 0.32%.

Top Performers:

Nifty IT Index: Outperformed with an advantage of 3.29%, led with the aid of strong performances from Tata Consultancy Services, Mphasis, HCL Tech, LTIMindtree, and Infosys.

Nifty Realty Index: Followed intently, rising by way of over 3%.

Other extremely good gainers protected:

Nifty FMCG, Nifty PSU Bank, and Nifty OMCs, every up by using over 2%.

Key Takeaway

Bulls ruled the marketplace on Friday, propelling benchmark indices to substantial profits. Broad-primarily based buying throughout sectors led with the aid of IT and realty, underscores sturdy investor confidence because the market’s equipment is up for the following week.

Look out for Business News For Profit’s marketplace and watch critiques for a deeper dive and expert perspectives in the marketplace’s country. In the inventory market’s ever-evolving panorama, our commitment to providing accurate and well-timed information will maintain manual traders in making informed selections.

Disclaimer

The statistics furnished in this newsletter are for informational features and must no longer be construed as economic recommendations. The inventory marketplace is concerned with dangers, and beyond overall overall performance does not assure destiny outcomes. Always behavior thorough studies and are searching for advice from an authorized financial advertising representative earlier before making any investment selections.

+ There are no comments

Add yours