Indian fairness benchmarks extended their prevailing streak for the fourth consecutive session on Wednesday. The BSE Sensex ended 110.58 points higher, or 0.14%, at 80,956.33, buying and selling in the variety of 81,245.39 to 80,630.53. Meanwhile, the NSE Nifty50 closed at 24,467.45, up 10.30 points or 0.04%, after accomplishing an intra-day excessive of 24,573.20 and a low of 24,366.30.

Key Highlights from the Trading Session

Market Breadth:

On the Nifty50, 30 out of 50 constituent stocks closed inside the red, with wonderful losses from Bharti Airtel, Cipla, Bajaj Auto, Tata Motors, and Adani Ports, declining up to 2.28%. On the opposite hand, HDFC Life, HDFC Bank, Apollo Hospitals, NTPC, and Bajaj Finserv had been a few of the 20 gainers, with will increase of up to 2.52%.

HDFC Bank’s Performance:

Index heavyweight HDFC Bank reached a document closing high of ₹1,860 after touching its 52-week high of ₹1,865 for the day. The inventory contributed 217 factors to the BSE Sensex, stopping the index from slipping into bad territory.

Sectoral and Broader Market Trends

Broader Markets Outperform:

The Nifty Midcap100 index rose by way of 1.05%, while the Nifty Smallcap100 index gained 0.89%, outperforming the benchmarks.

Volatility Gauge:

The India VIX, a measure of marketplace volatility, climbed 0.86% to 14.50, reflecting heightened market uncertainty.

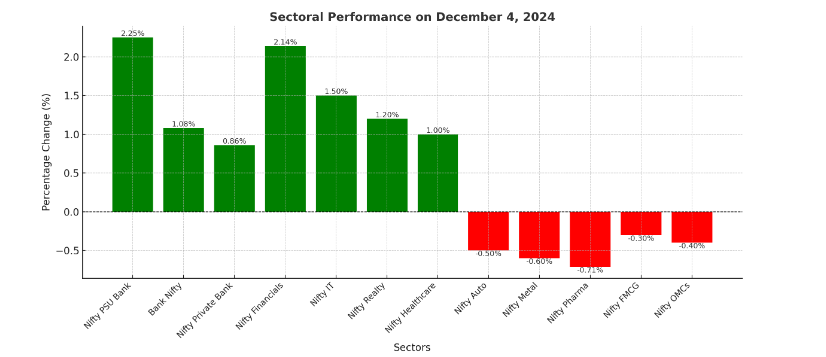

Sectoral Performances:

- Top Gainers: Banking shares led the rally, with the Nifty PSU Bank index surging 2.25%. The Bank Nifty and Nifty Private Bank indices accompanied, up 1.08% and 0.86%, respectively.

- Other sectors within the green covered Nifty Financials, IT, Realty, and Healthcare, with gains up to 2.14%.

- Top Losers: Indices for Auto, Metal, Pharma, FMCG, and OMCs ended in the pink, declining up to 0.71%.

Conclusion

Despite an uneven buying and selling consultation, Indian fairness markets maintained their upward momentum, way to strong performances in the banking and economic sectors. The broader markets’ outperformance and HDFC Bank’s stellar showing have been instrumental in maintaining the benchmarks in fantastic territory. However, rising volatility and mixed sectoral tendencies sign a cautious market sentiment.

+ There are no comments

Add yours