The Indian started out December on a high-quality note, with benchmark indices convalescing from early losses to end in the inexperienced. The BSE Sensex gained 445.29 points, or 0.65%, last at eighty,248.08 after briefly slipping under the 80,000 mark throughout early alternate. The preliminary dip was influenced by the aid of India’s Q2 GDP file, which fell brief of marketplace expectations, and issues over US President-Go Donald Trump’s warning to impose a hundred tariffs on BRICS countries if they act to undermine the United States dollar’s worldwide dominance.

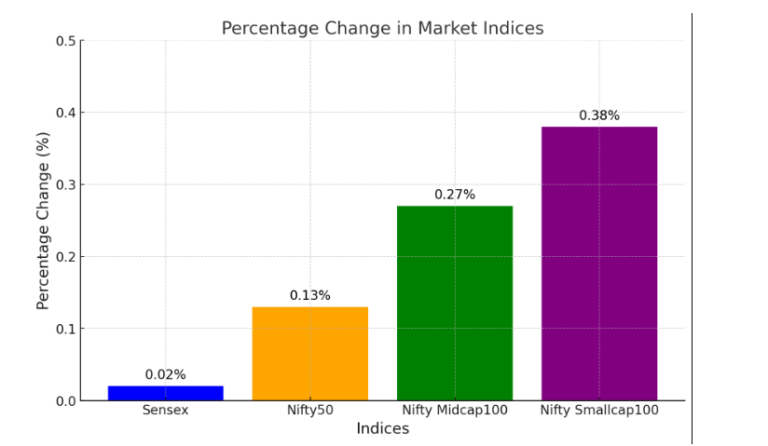

Similarly, the NSE Nifty50 closed a hundred and 44.95 points higher, gaining 0.6% to settle at 24,276.05. The index traded within several 24,301.70 to 24,008.65 during the session.

Top Performers and Sectoral Trends

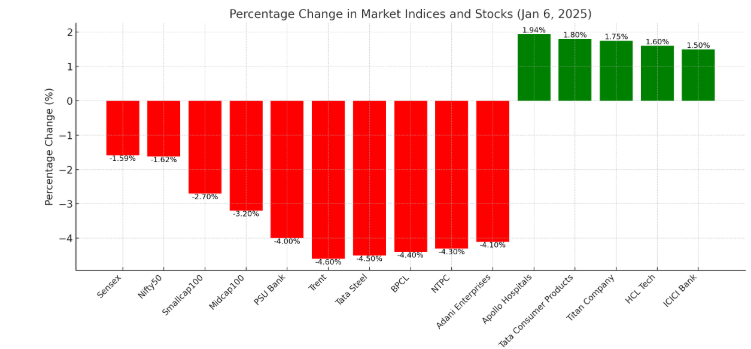

Out of the 50 Nifty50 components, 31 shares ended in the green. Leading the gainers were UltraTech Cement, Apollo Hospitals, Grasim, JSW Steel, and Shriram Finance, with gains of up to 3.82%. On the other hand, HDFC Life, NTPC, Cipla, SBI Life, and Hindustan Unilever were the pinnacle laggards, posting losses of up to 2.67%.

Mid-cap and small-cap shares outperformed the benchmarks, because the Nifty Midcap100 and Nifty Smallcap100 indices posted gains of 1.08% and 1.04%, respectively.

While most sectoral indices ended in the green, the Nifty FMCG and PSU Bank indices closed in negative territory. Realty shares were the standout performers, with the Nifty Realty index advancing by 3%. Consumer durables followed in shape, with the Nifty Consumer Durables index gaining 2%.

Other sectors along with Healthcare, Media, and Metals noticed gains of over 1%, at the same time as Auto, IT, and Pharma additionally ended nearly 1% higher.

The day’s healing suggests resilience within the market, despite global and domestic financial demanding situations.

Look out for Business News For Profit’s marketplace and watch critiques for a deeper dive and expert perspectives in the marketplace’s country. In the inventory market’s ever-evolving panorama, our commitment to providing accurate and well-timed information will maintain manual traders in making informed selections.

Disclaimer

The statistics furnished in this newsletter are for informational features and must no longer be construed as economic recommendations. The inventory marketplace is concerned with dangers, and beyond overall overall performance does not assure destiny outcomes. Always behavior thorough studies and are searching for advice from an authorized financial advertising representative earlier before making any investment selections.

+ There are no comments

Add yours