-Sujata Muguda

Indian customers and investors can sit up for extended harm because the inventory marketplace may be closed on Friday, November 15, 2024, in observance of Guru Nanak Jayanti. Following this vacation, markets will continue to be closed over the weekend, reopening on Monday, November 18, 2024, developing a 3-day respite for market contributors. Guru Nanak Jayanti commemorates the beginning of Guru Nanak Dev, the founder of Sikhism and the first of the ten respected Sikh Gurus, born in 1469.

On Friday, the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE) will drop trading sports across segments, including stocks, derivatives, and securities lending and borrowing (SLB). Indian stock markets normally carry out from Monday to Friday, with enormous trading hours from 9:15 AM to 3:30 PM and a pre-open consultation from 9:00 AM to 9:15 AM. The marketplace stays closed on weekends.

Commodity Market Schedule on Guru Nanak Jayanti

While the equity markets may be fully closed on Friday, November 15, the Multi Commodity Exchange (MCX) will carry out sooner or later of its middle-of-the-night session, from 5 PM to 11:30 PM or 11:55 PM. However, the National Commodity & Derivatives Exchange (NCDEX), India’s main agri-commodity exchange, might be closed for the whole day.

Market Recap: Benchmark Indices Close in Red Ahead of Long Weekend

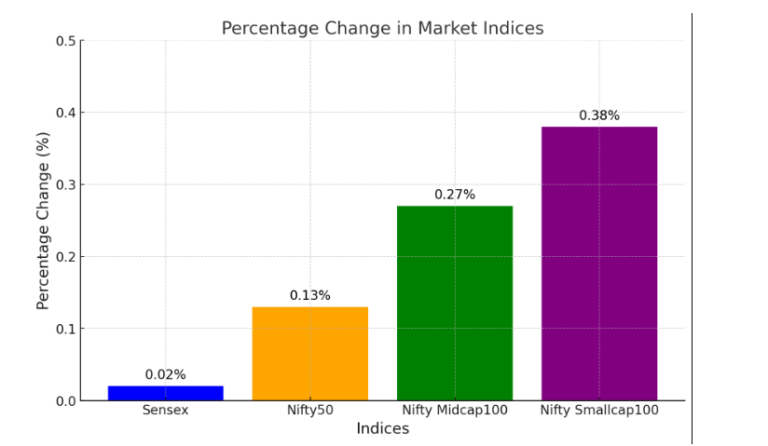

In the final trading session earlier than the holiday, benchmark indices showed slight declines. The BSE Sensex dropped one hundred 10.64 points (0.14%) to close at 77,580.31, at the same time as the NSE Nifty50 fell through 26.35 factors (0.11%) to settle at 23,532.70. Of the 50 shares within the Nifty50, 29 ended the day in the purple. The largest detractors have been Hindustan Unilever, Britannia Industries, BPCL, Tata Consumer, and Nestle India, with every decline going up to 2.92%.

Conversely, 19 shares managed to position up profits. Eicher Motors, Hero MotoCorp, Grasim, Kotak Mahindra Bank, and HDFC Life led the splendid momentum, with earnings of up to 6.59%.

As markets put together to renew next Monday, buyers may be looking for any international cues that would affect early-week sentiment.

Disclaimer:

These facts are supplied for fashionable informational functions and are not intended as financial, investment, or buying and selling recommendations. Market vacations and timings are challenges to trade; buyers are encouraged to confirm with authentic assets or their brokerage companies. Neither the writer nor the writer assumes liability for capacity losses or damages because of reliance on this data. Always discuss with a qualified monetary professional for unique advice tailor-made to your economic situation.

+ There are no comments

Add yours