Indian equity benchmarks, BSE Sensex and NSE Nifty 50, remained risky on Friday as the Reserve Bank of India (RBI) Governor announced keeping the popularity quo at the repo charge. The selection to keep costs consistent aligns with marketplace expectancies, aiming to balance inflationary pressures and economic increases.

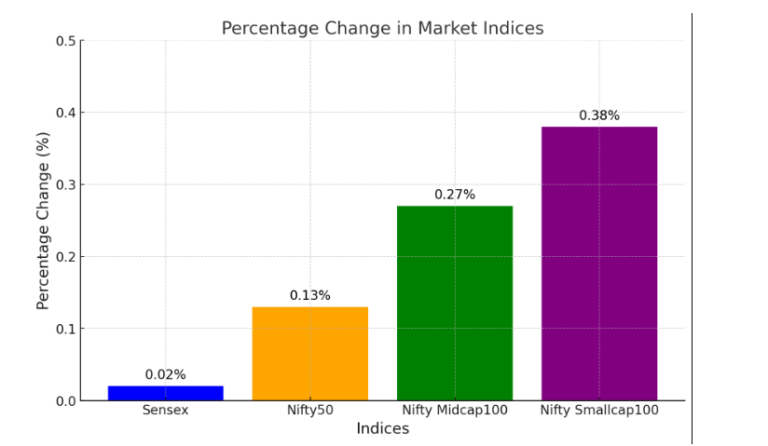

At around 10:40 AM, the BSE Sensex became buying and selling at 81,796.22, recording a minor benefit of 30.36 points or 0.04%. Meanwhile, the NSE Nifty 50 stood at 24,717.95, up via nine.55 points or 0.04%.

The market mood was regarded carefully as contributors assessed the results of the RBI’s unchanged coverage stance. Banking and financial stocks were under scrutiny, reacting to the coverage update, at the same time as the IT and pharma sectors witnessed the combined overall performance. Broader indices, consisting of mid-cap and small-cap stocks, showed a flat fashion, mirroring the general subdued sentiment.

On the worldwide front, susceptible cues from Asian markets and overnight declines on Wall Street contributed to the cautious buying and selling surroundings. Investors globally continue to be alert to signals from the U.S. Federal Reserve on ability fee actions, adding to market uncertainty.

Looking in advance, market actions might be driven using sectoral tendencies, institutional flows, and worldwide marketplace dynamics. Investors are advised to undertake a disciplined technique, specializing in fundamentally robust shares.

Disclaimer:

Investments in the stock marketplace are a problem of marketplace dangers. The above statistics are for instructional and informational purposes and have to not be taken into consideration as economic recommendations. Please seek advice from a certified financial advisor earlier than making any investment decisions.

+ There are no comments

Add yours