Stock Market Live Updates fairness benchmarks commenced Thursday’s consultation on a subdued word, tracking combined cues from Asian markets.

The BSE Sensex became buying and selling close to its preceding close on the 80200 level, shifting within a slender range of one hundred fifty factors, hitting an intraday excessive of 80,329 and a low of eighty,189. Meanwhile, the NSE Nifty 50 traded flat, soaring around 24,270.

Key Movers

Among the Sensex 30 shares, extraordinary gainers included Hindustan Unilever, ITC, NTPC, and HDFC Bank. However, Infosys, SBI, and Mahindra & Mahindra have been marginally inside the purple.

Market Influencers

Market sentiment was shaped by way of more than one factor:

- F&O Expiry: The monthly futures and options expiry may want to impact volatility.

- Bank of Korea Rate Hike: A 25 basis points price hike by the Bank of Korea delivered an international macroeconomic layer to investor choices.

- US Economic Data: The US GDP increase aligned with expectations, whilst a dip inside the greenback before the Thanksgiving excursion indicated decreased trading activity.

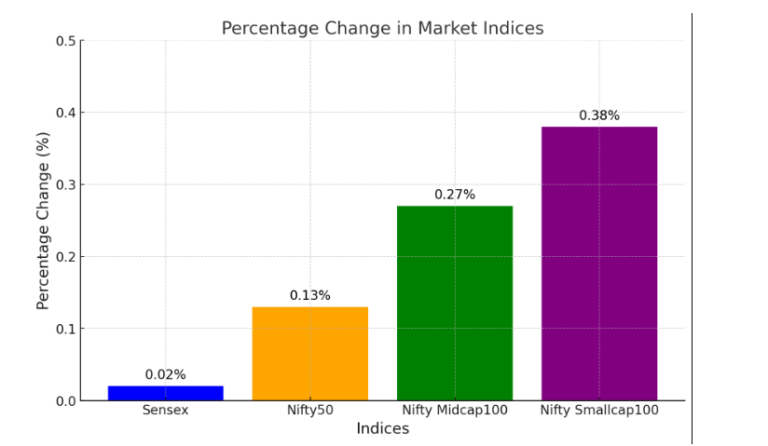

Broader Market Performance

The BSE SmallCap index outperformed in the broader marketplace with a 0.6% advantage. Top performers protected Honasa Consumer, HUDCO, NBCC (India), and KEC International. The BSE MidCap index additionally saw a modest uptick of 0.2%.

Primary Market Activity

- No mainline IPOs have been indexed, with all public proportion income on the SME platform.

- Agarwal Toughened Glass India IPO is open for subscription these days.

- Abha Power and Steel and Apex Ecotech endured accepting bids for the second day, even as Rajputana Biodiesel closed its subscription length.

- The allotment for Rajesh Power Services (SME) IPO is scheduled for today.

Global Market Snapshot

Asian markets showed blended trends:

- Japan’s Nikkei rose through 0.5%.

- Straits Times and Kospi posted marginal gains.

- Hang Seng and Taiwan indices edged decrease.

In the USA, benchmark indices ended Wednesday with losses of as much as 0.6%, as the Dow Jones reversed early gains to shut inside the crimson. Trading volumes have been muted beforehand of Thanksgiving, with a half-day session deliberate for Friday.

Commodity Watch

Gold Outlook: Goldman Sachs projected a bullish case for gold, awaiting costs to reach $three, hundred and fifty according to ounce by using December 2025—a capability 19% upside from contemporary tiers. Gold stays a favored hedge against persistent inflation and geopolitical dangers.

Highlights from Wednesday

The Sensex and Nifty ended Wednesday’s session with modest profits. Debutant NTPC Green Energy and Adani Group stocks had been superb performers, at the same time as 387 stocks hit their upper circuit.

Disclaimer:

Investments in the stock marketplace are a problem of marketplace dangers. The above statistics are for instructional and informational purposes and have to not be taken into consideration as economic recommendations. Please seek advice from a certified financial advisor earlier than making any investment decisions.

+ There are no comments

Add yours