Indian equity indices surged on Tuesday morning, monitoring overnight profits on Wall Street. As of 10 AM, the BSE Sensex was up by 785 points (1.02%) at 78,124, even as the Nifty 50 climbed 235.60 factors (1%) to exchange at 23,689.

Despite concerns over capacity inflationary pressures in the U.S. Financial system because of President-elect Donald Trump’s proposed tariffs, tax cuts, and deregulations, investor optimism about a robust U.S. Financial system drove gains in U.S. Equity markets. On Monday, the S&P 500 and Nasdaq Composite ended higher, whilst the Dow Jones Industrial Average closed barely decreased.

Monday Market Recap:

The Indian markets ended Monday in bad territory, reflecting weak international cues:

BSE Sensex dropped 241.30 factors (0.31%) to shut at 76,339.01, trading between 76,965.06 and 77,886.97.

Nifty 50 lost 78.90 points (0.34%) to settle at 23,453, after moving inside the variety of 23,350.40-23,606.80.

The volatility gauge, India VIX, rose by means of 2.65% to 15.17, indicating heightened marketplace uncertainty.

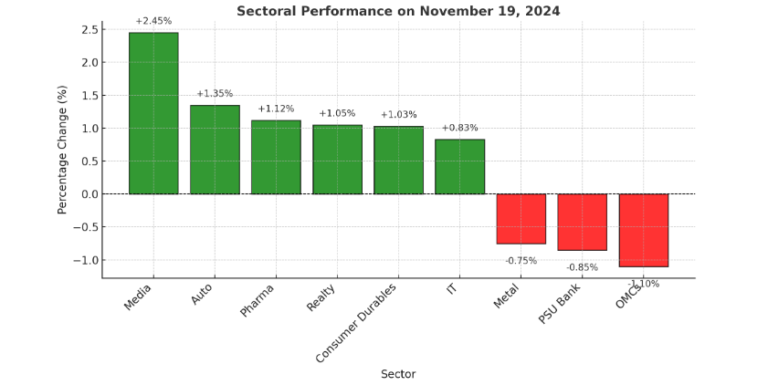

Sectoral Performance:

Losers:

Nifty IT plunged 2.32%, whilst indices like Media, Pharma, CPSE, and Healthcare also saw declines of up to at least one.60%.

Gainers:

Nifty FMCG, Metal, Banking, Realty, Financial Services, and Consumer Durables outperformed, gaining up to 1.90%.

Broader Markets:

The Nifty Smallcap a hundred index declined 0.53%, while the Nifty Midcap a hundred closed flat, indicating combined sentiments throughout mid- and small-cap shares.

The markets look ahead to further cues on global monetary regulations and their implications for inflation and interest quotes. Stay tuned for greater updates all through the day.

Disclaimer:

The facts furnished in this article is for informational functions simplest and must now not be considered as financial or funding advice. Stock marketplace investments are difficult to market dangers, and beyond performance does no longer guarantee future outcomes. Readers are counseled to conduct their very own studies and visit a certified economic marketing consultant earlier than making any funding choices. The publisher isn’t answerable for any losses incurred as a result of the use of these facts.

+ There are no comments

Add yours