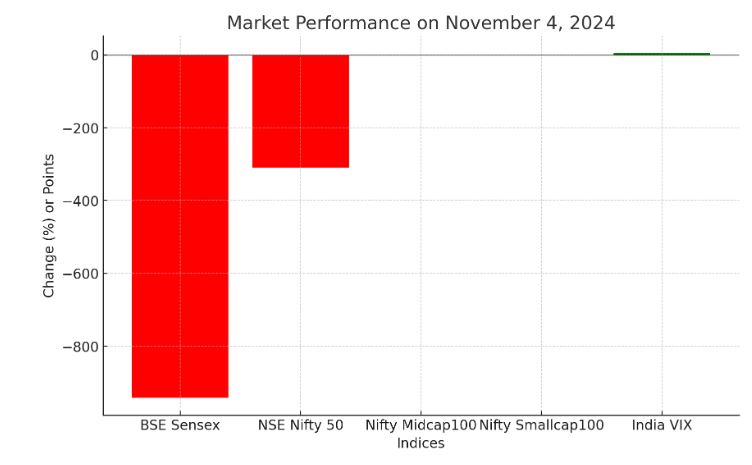

On Monday, November 4, 2024, India’s benchmark equity indices, BSE Sensex and NSE Nifty 50, wrapped up the first trading consultation of the week deep in negative territory, ever losing greater than 1% amid a wave of huge-based promoting. The BSE Sensex fell with the aid of 941.88 points, or 1.18%, final at 78,782.24. Similarly, the NSE Nifty 50 saw a drop of 309 points, or 1.27%, ending at 23,995.35.

The market became gripped using a bearish sentiment as 42 of the 50 shares inside the Nifty 50 closed within the purple. Major laggards blanketed Hero MotoCorp, Grasim Industries, Bajaj Auto, Adani Ports, and BPCL, every logging declines of as much as 4.25%. The sell-off turned attributed to growing caution among buyers, who preferred to reduce chance amid worries about worldwide uncertainties and market volatility.

A handful of shares, however, controlled to break out the rout. Mahindra & Mahindra, Tech Mahindra, Cipla, State Bank of India, and Dr. Reddy’s Labs had been a few of the few gainers within the Nifty 50, with those stocks seeing gains of up to 2.14%. The selective buying in those counters indicated that traders had been favoring defensive stocks or organizations with a greater stable outlook amid market fluctuations.

Volatility inside the marketplace changed into also at the upward push. The India VIX, a key indicator of market sentiment regularly known as the “fear index,” jumped 5.01% to 16.70 factors, reflecting heightened uncertainty and anxiety among investors. As volatility rose, broader indices mirrored the fashion, with each of the Nifty Midcap100 and Nifty Smallcap100 finishing inside the red. The Nifty Midcap100 slipped by 1.31%, whilst the Nifty Smallcap100 noticed a sharper decline of 1.98%.

All sectoral indices closed the day lower, underscoring the giant nature of the market’s weak spot. Nifty OMCs, Realty, and Media led the decline, finishing the session down by greater than 2%. These were observed through sectors including Financials, FMCG, Metal, Private Bank, and Consumer Durables, which noticed declines exceeding 1%. The throughout-the-board promoting in sectoral indices pointed to a cautious market surrounding, with concerns over macroeconomic elements possibly influencing investor sentiment.

The marketplace weakness is anticipated to linger within the close term as international factors, consisting of fluctuations in crude oil costs and overseas investor sentiment, continue to weigh on the home fairness market. Investors and analysts alike are watching for cues from worldwide markets and developments in major economies, which can also shape the marketplace’s overall performance within the coming days.

Monday’s consultation emphasized the want for caution and hazard control, particularly for retail investors. As volatility stays multiplied and sectoral indices reflect significant promoting stress, market individuals might also choose protective performs or keep off on foremost investments until greater readability emerges concerning each domestic and international monetary situation.

Look out for Business News For Profit’s marketplace watch reports for a deeper dive and professional perspectives on the market’s nation. In the inventory marketplace’s ever-evolving panorama, our commitment to imparting correct and timely statistics will preserve to guide traders in making informed decisions.

Disclaimer

The records supplied in this article are for informational functions and have to now not be construed as financial advice. The stock marketplace is subject to risks, and past performance does now not assure destiny consequences. Always behavior thorough studies and consult with a qualified financial marketing consultant earlier than making any funding selections.

+ There are no comments

Add yours