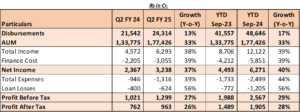

Chennai, October 25th, 2024: The Board of Directors of CIFCL today approved the unaudited financial results for the quarter and half year ended 30th September 2024.

Performance Highlights:

- Aggregate disbursements in Q2 FY 25 were at ₹ 24,314 Cr as against ₹ 21,542 Cr in Q2 FY 24 registering a growth of 13%. Disbursements in H1 FY 25 were at ₹ 48,646 Cr as against ₹ 41,557 Cr registering a growth of 17% on Y-o-Y basis.

- Vehicle Finance (VF) disbursements were at ₹ 12,336 Cr in Q2 FY 25 as against ₹ 11,731 Cr in Q2 FY24, registering a growth of 5%. Disbursements in H1 FY 25, were at ₹ 25,102 Cr as against ₹ 23,032 Cr in the previous year, registering a growth of 9% Y-o-Y.

- Loan Against Property (LAP) business disbursed ₹ 4,295 Cr in Q2 FY 25, as against ₹ 3,192 Cr in Q2 FY24, registering a growth rate of 35%. Disbursements in H1 FY 25, were at ₹ 8,170 Cr as against ₹ 5,872 Cr in the previous year, registering a growth of 39% Y-o-Y.

- Home Loan business disbursed ₹ 1,823 Cr in Q2 FY 25, as against ₹ 1,575 Cr in Q2 FY24 registering a growth of 16%. The Disbursements in H1 FY 25 were at ₹ 3,601 Cr as against ₹ 3,029 Cr in the previous year, registering a growth of 19% Y-o-Y.

- Small and Medium Enterprises Loan (SME) business disbursed ₹ 1,959 Cr in Q2 FY 25, as against ₹ 1,945 Cr in Q2 FY24 registering a growth of 1%. The disbursements in H1 FY25 were at ₹ 4,119 Cr, registering 3% growth over ₹ 3,990 Cr in H1 FY 24.

- Consumer and Small Enterprise Loans (CSEL) disbursed ₹ 3,588 Cr in Q2 FY 25, as against ₹ 2,853 Cr in Q2 FY24 registering a growth of 26%. The disbursements in H1 FY25 were at ₹ 7,075 Cr, registering 36% growth over ₹ 5,207 Cr in H1 FY 24.

- Secured Business and Personal Loan (SBPL) disbursed ₹ 312 Cr in Q2 FY 25, as against ₹ 246 Cr in Q2 FY24 registering a growth of 27%. The disbursements in H1 FY25 were at ₹ 580 Cr, registering 36% growth over ₹ 428 Cr in H1 FY 24.

- Assets under management as of 30th September 2024, stood at ₹ 1,77,426 Cr as compared to ₹ 1,33,775 Cr as of 30th September 2023, clocking a growth of 33% Y-O-Y.

- PBT Growth in Q2 was at 27% and for H1 was at 29%.

- PBT-ROA for Q2 FY 25 was at 3% and for the half year was at 3.1%.

- ROE for Q2 FY 25 was at 18.24%. and for the half year was at 18.55%.

The Company continues to hold a strong liquidity position with ₹ 13,864 Cr as cash balance as at end of Sep’2024 (including ₹ 2,563.25 crs invested in G-sec / ₹ 2,106.22 cr invested T-bill & ₹ 623.85 crs invested in Strips shown under investments), with a total liquidity position of ₹ 14,404 Cr (including undrawn sanctioned lines). The ALM is comfortable with no negative cumulative mismatches across all time buckets as per Regulatory norms.

Consolidated Profit Before Tax (PBT) for Q2 FY 25 was at ₹ 1,304 Cr as against ₹ 1,065 Cr in Q2 FY 24 registering a growth of 22% and for H1 FY 25 was at ₹ 2,579 Cr as against ₹ 2,021 Cr in H1 FY 24 registering a growth of 28%.

Asset Quality:

Stage 3 levels representing 90+ dues increased to 2.83% as of September 24 from 2.62% as of the end of June 24. GNPA % as per RBI norms increased to 3.78% as of September 24 as against 3.62% on June 24. NNPA as per RBI norms has also increased to 2.48% as of September 24 against 2.37% on June 24. NNPA is below the threshold of 6% prescribed by RBI as the threshold for PCA.

Capital Adequacy:

The Capital Adequacy Ratio (CAR) of the company as of 30th September 2024, was at 19.50% as against the regulatory requirement of 15%. Tier-I Capital was at 15.04% (Common Equity Tier-I Capital at 14.20% as against a regulatory minimum of 9%) and Tier-II Capital was at 4.46%.

+ There are no comments

Add yours