Stock Market Crash Highlights, October 25:

India’s stock markets persisted their downward trajectory into a 5th instant consultation on Friday, as sustained foreign investor selling, lackluster September quarter profits, and valuation worries weighed closely on investor sentiment. The benchmark indices posted a fourth consecutive week of losses, marking their longest weekly dropping streak considering August 2023, with each the Nifty50 and Sensex losing over 7% throughout this era.

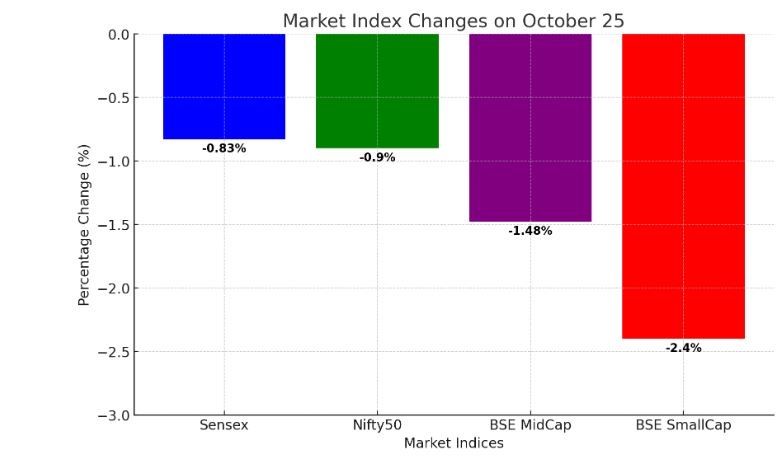

The BSE Sensex plunged through 662.87 points (0.83%) to shut at 79,402.29, at the same time as the Nifty50 fell underneath the crucial 24,2 hundred level, ending the consultation at 24, hundred and eighty.80, down by 218.63 points (0.9%).

Of the Sensex’s 30 constituents, 20 ended inside the crimson, at the side of 38 of the Nifty’s 50 stocks. The day’s largest laggards protected IndusInd Bank (down 18.99%), Adani Enterprises, Shriram Finance, BPCL, M&M, Coal India, L&T, NTPC, Adani Ports, Tata Consumer Products, and Bajaj Finance, which all saw declines of around 2%.

However, a few stocks managed to secure modest profits. ITC, Axis Bank, HUL, Britannia Industries, Sun Pharma, Kotak Bank, Bharat Electronics, and HCL Tech inched up with profits of up to 2.2%.

Broader marketplace indices also took a hit: the BSE MidCap index declined by 1.48%, even as the SmallCap index fell with the aid of 2.4%. Over the beyond seven days, mid- and small-cap indices have dropped close to 9% and are nearing the ‘correction’ area.

Bears ruled the marketplace these days, with about three,087 stocks on the BSE closing in the red in comparison to the simplest 856 advancing stocks. The marketplace capitalization of all BSE-indexed corporations dropped to Rs 437.7 trillion.

Sector-sensible, the Nifty Auto, Media, Metal, and PSU Bank indices every slipped by 2%. Defensive sectors like Nifty Pharma and FMCG supplied some respite, gaining up to 0.88%.

Look out for Business News For Profit’s marketplace watch reports for a deeper dive and professional perspectives on the market’s nation. In the inventory marketplace’s ever-evolving panorama, our commitment to imparting correct and timely statistics will preserve to guide traders in making informed decisions.

Disclaimer

The records supplied in this article are for informational functions and have to now not be construed as financial advice. The stock marketplace is subject to risks, and past performance does now not assure destiny consequences. Always behavior thorough studies and consult with a qualified financial marketing consultant earlier than making any funding selections.

+ There are no comments

Add yours